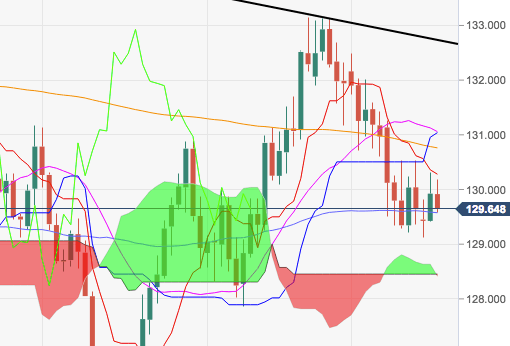

- EUR/JPY continues to trade in an erratic fashion so far this week, finding support in the 129.00 neighbourhood and with gains capped around the 200-day SMA, today at 130.75.

- A surpass of the 200-day SMA should open the door for a potential visit to the 21-day SMA just above 131.00 the figure.

- Further north, the cross needs to advance beyond the resistance line at 132.73 to allow for, initially, a test of September’s peaks beyond the 133.00 handle ahead of October 2017 tops in the mid-134.00s.

- However, as long as the resistance line above 132.70 caps the upside, a resumption of the downtrend should not be ruled out.

EUR/JPY daily chart

EUR/JPY

Overview:

Last Price: 129.66

Daily change: -26 pips

Daily change: -0.200%

Daily Open: 129.92

Trends:

Daily SMA20: 131.13

Daily SMA50: 129.62

Daily SMA100: 129.47

Daily SMA200: 130.81

Levels:

Daily High: 130.32

Daily Low: 129.41

Weekly High: 131.26

Weekly Low: 129.21

Monthly High: 133.15

Monthly Low: 129.21

Daily Fibonacci 38.2%: 129.97

Daily Fibonacci 61.8%: 129.76

Daily Pivot Point S1: 129.45

Daily Pivot Point S2: 128.98

Daily Pivot Point S3: 128.55

Daily Pivot Point R1: 130.36

Daily Pivot Point R2: 130.79

Daily Pivot Point R3: 131.26