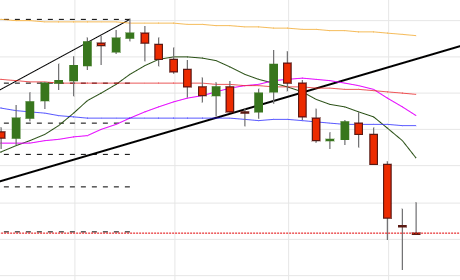

- The softer tone around the single currency in combination with the demand for the safe haven Japanese Yen as of late have intensified the leg lower in the cross, which is so far navigating its fifth week in a row with losses.

- EUR/JPY tested the vicinity of the 125.00 milestone on Monday, although some dip-buyers managed to push the cross back above 126.00 the figure today, where it is flirting with the 78.6% Fibo retracement of the May-July rally (126.20).

- The breakdown of the 129.00 area has opened the door for a potential decline and test of 2018 lows in the 124.60 region.

- However, the oversold condition of the cross (RSI at 28 today) could allow for some occasional rebounds, which are expected to meet interim resistance at 128.22 (10-day SMA) ahead of the critical 129.00 area. The latter is reinforced by the 38.2% Fibo of the May-July up move.

EUR/JPY daily chart

Daily high: 127.01

Daily low: 126.04

Support Levels

S1: 125.38

S2: 124.44

S3: 123.73

Resistance Levels

R1: 127.03

R2: 127.74

R3: 128.68