- The US-China negotiation driven risk sentiment favors safe-havens like the JPY.

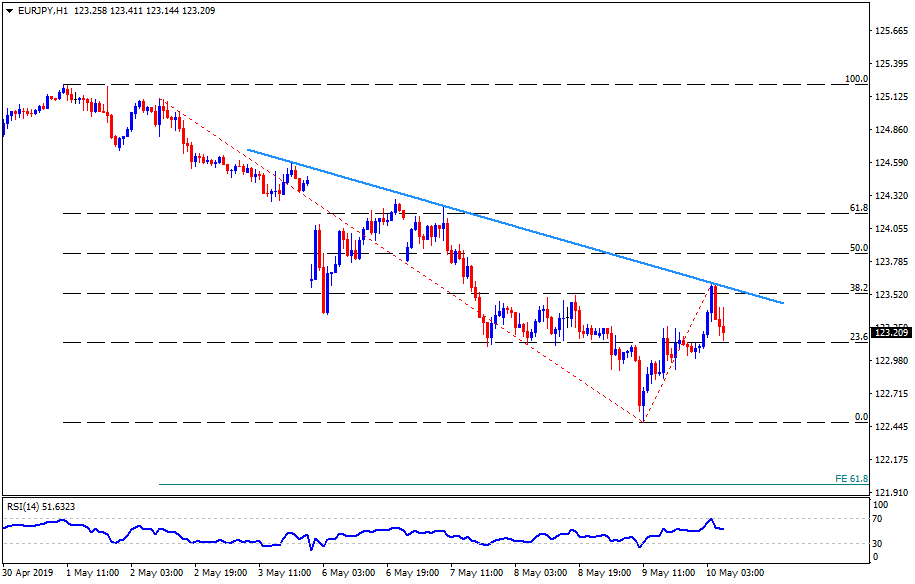

- U-turn from immediate resistance-line highlights recent lows.

With the risk aversion ruling over market sentiment off-late, the EUR/JPY pair took a U-turn from immediate resistance-line as it trades near 123.20 ahead of the Europe markets open on Friday.

Considering the pair’s latest pullback from short-term resistance, coupled with the risk-on sentiment, chances of its further declines to 123.00, 122.85 and recent lows near 122.50 can’t be denied.

In case of additional south-run below 122.50, 61.8% Fibonacci expansion of moves since early-month can please sellers with 122.00 the figure.

On the flip side, a break of 123.60 resistance-line can trigger the quote’s rise to 124.30 whereas 124.70 could flash on the chart afterward.

Given the prices keep rallying beyond 124.70, 125.00 and 125.25/30 can become buyers’ next landmarks.

EUR/JPY hourly chart

Trend: Bearish