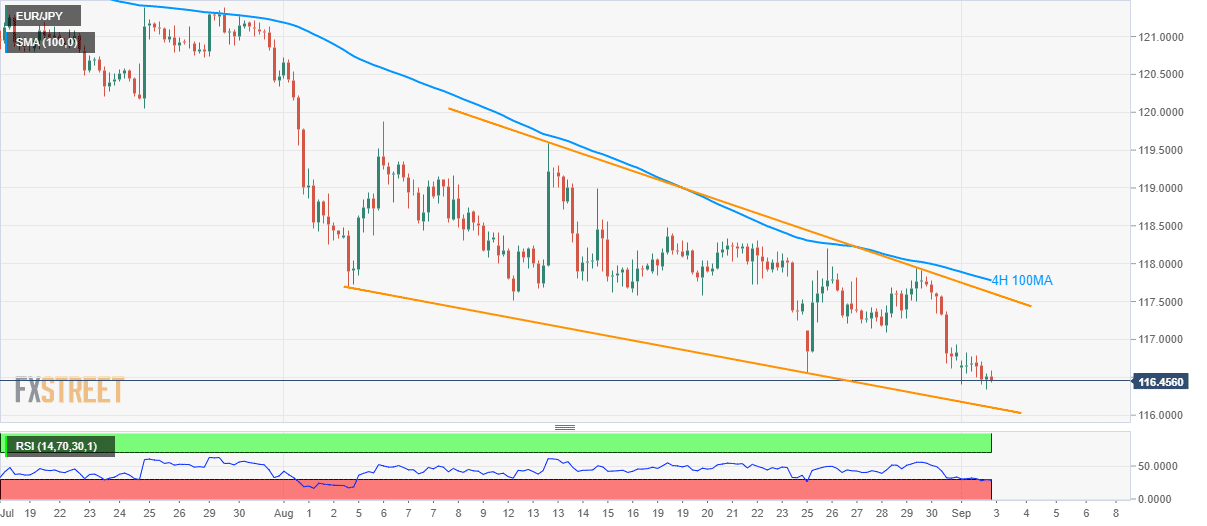

- The EUR/JPY pair’s current downpour can visit falling wedge’s support line.

- Oversold RSI conditions around multi-year low could trigger a pullback.

EUR/JPY remains on the back foot while trading near Monday’s multi-month low as it makes the rounds to 116.44 during early Tuesday morning in Asia.

The quote nears the lowest since April 2017 and is expected to decline further on the break of 116.35, comprising the previous day’s low. However, support-line of a short-term falling wedge bullish formation can limit further declines around 116.10 amid oversold conditions of 14-bar relative strength index (RSI).

If at all bears refrain from respecting 116.10, also dominate below 116.00 round-figure, April 2017 low of 114.85 will flash on their radar.

Meanwhile, 117.00, the formation’s resistance line near 117.62 and 100-bar simple moving average on the four-hour chart (4H 100MA) at 117.78 can keep limiting the pair’s upside.

It should, however, be noted that pair’s sustained break of 117.78 confirms a bullish pattern and will trigger fresh run-up towards early-August highs surrounding 120.00.

EUR/JPY 4-hour chart

Trend: pullback expected