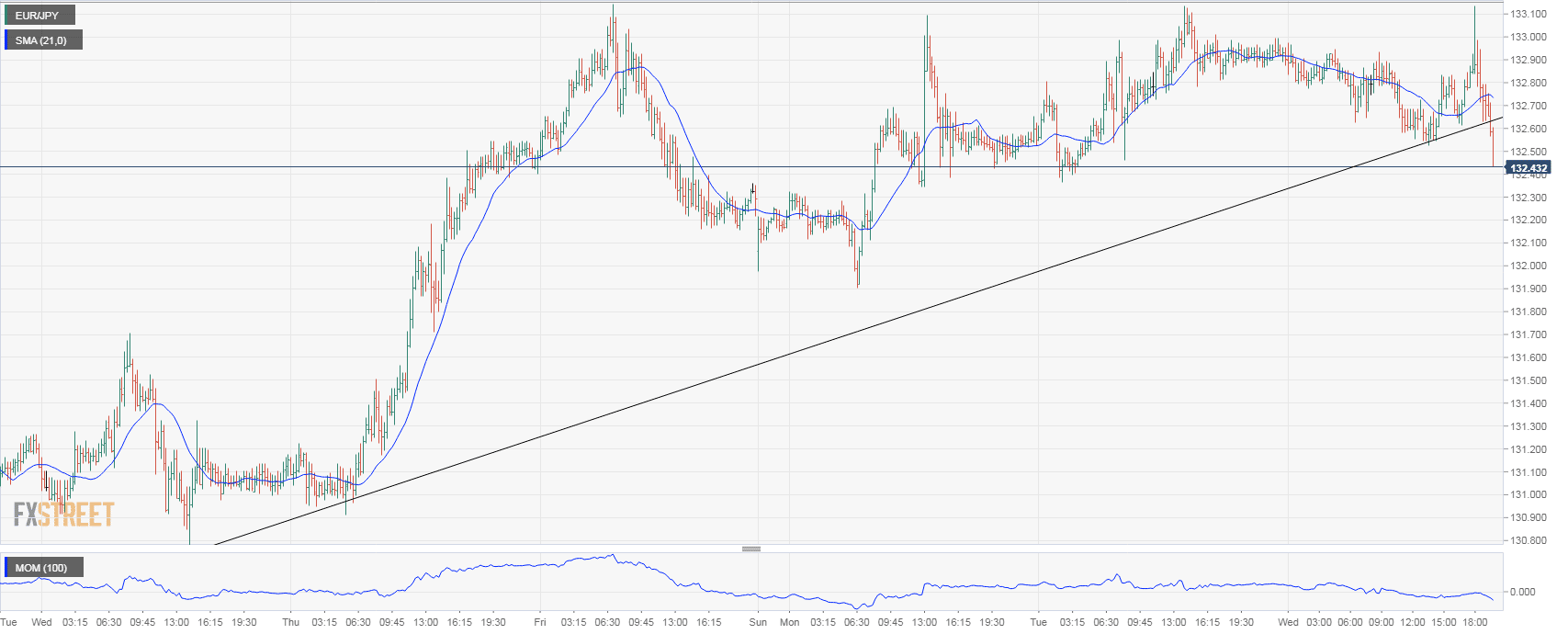

- EUR/JPY turned lower after the FOMC meeting, weakened mainly by a stronger Japanese yen.

- The pair rose to test monthly highs post-FOMC but failed to break and again was rejected from 133.00. Near the end of the US session, printed fresh daily lows under 132.50.

- Short-term moving averages are turning south and the upside shows exhaustion so a bearish correction seems likely. Immediate support is seen at 132.30, followed by the weekly low at 131.85/90.

- If the euro bounces and rises back above 132.85, another test of 133.00/10 could be seen. A consolidation on top of 133.10 is needed to open doors to more gains.

Spot rate: 132.40

High: 133.10

Low: 132.39

Trend: Sideways

Resistance 1: 132.85

Resistance 2: 133.10

Resistance 3: 133.45

Support 1: 132.30

Support 2: 131.90

Support 3: 131.50