- EUR/JPY holds its weakness below a short-term key moving average.

- The four-day-long descending trend-line, 200-hour EMA adds to resistance.

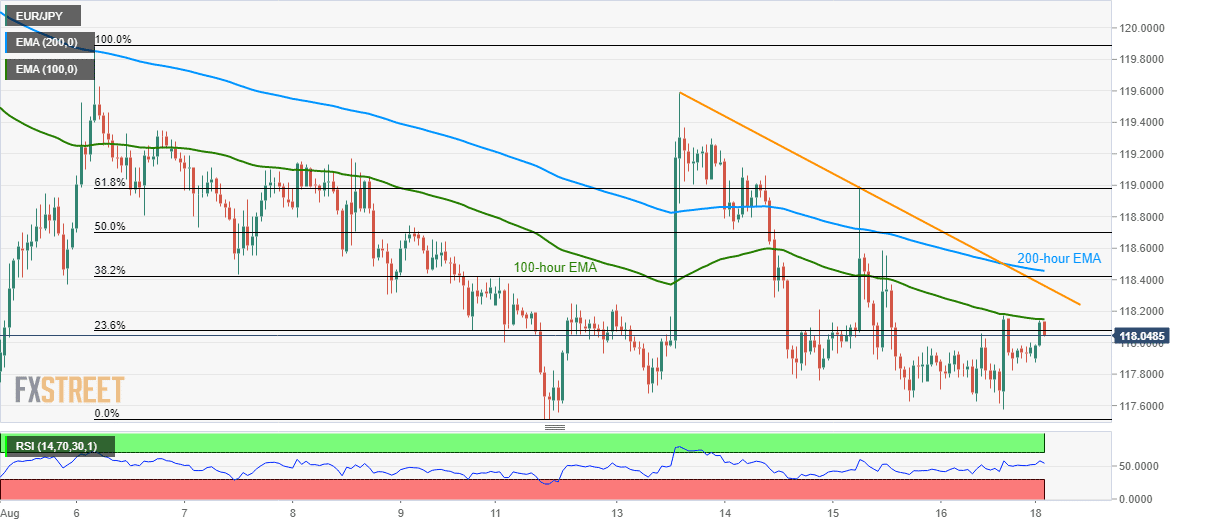

EUR/JPY registers another failure to cross 100-hour exponential moving average (EMA) as it declines to 118.08 during early Asian morning on Monday.

Not only 100-hour EMA level of 118.15 but a four-day long downward sloping trend-line, at 118.36 and 200-hour EMA near 118.45 also limit the pair’s short-term upside.

As a result, bulls targeting a return of 119.00, 119.60 and 120.00 should wait for a sustained break of aforementioned levels.

Until then, 117.80 and the latest low close to 117.50 could be on the lookout for sellers ahead of targeting further lows of 2017.

EUR/JPY hourly chart

Trend: Pullback expected