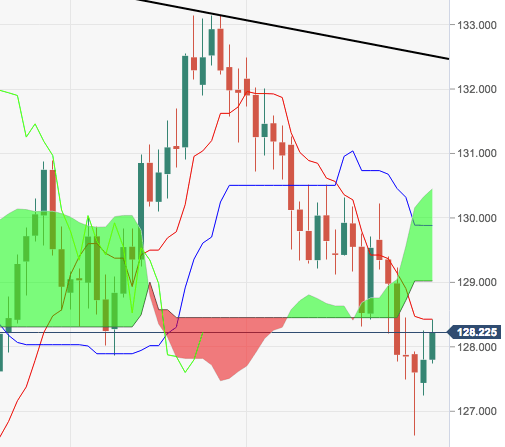

- The prevailing selling mood continues to hurt the Japanese Yen and is therefore propelling the recovery in EUR/JPY from last week’s lows in the 126.65/60 band.

- The ongoing recovery should meet initial hurdle at the 10-day SMA at 128.54 and could extend to the 129.00 neighbourhood and above, where is located the 21-day SMA and 100-day SMA, at 129.46 and 129.47, respectively.

- In case the cross resumes the down trend, last week’s low at 126.61 could pave the way for a potential visit to August’s low at 124.90, regarded as the last defense of a probable test of YTD low at 124.61 seen in late-May.

EUR/JPY daily chart

EUR/JPY

Overview:

Last Price: 128.19

Daily change: 39 pips

Daily change: 0.305%

Daily Open: 127.8

Trends:

Daily SMA20: 129.51

Daily SMA50: 129.95

Daily SMA100: 129.47

Daily SMA200: 130.52

Levels:

Daily High: 128.26

Daily Low: 127.24

Weekly High: 130.22

Weekly Low: 126.63

Monthly High: 133.15

Monthly Low: 127.87

Daily Fibonacci 38.2%: 127.87

Daily Fibonacci 61.8%: 127.63

Daily Pivot Point S1: 127.28

Daily Pivot Point S2: 126.76

Daily Pivot Point S3: 126.27

Daily Pivot Point R1: 128.29

Daily Pivot Point R2: 128.78

Daily Pivot Point R3: 129.3