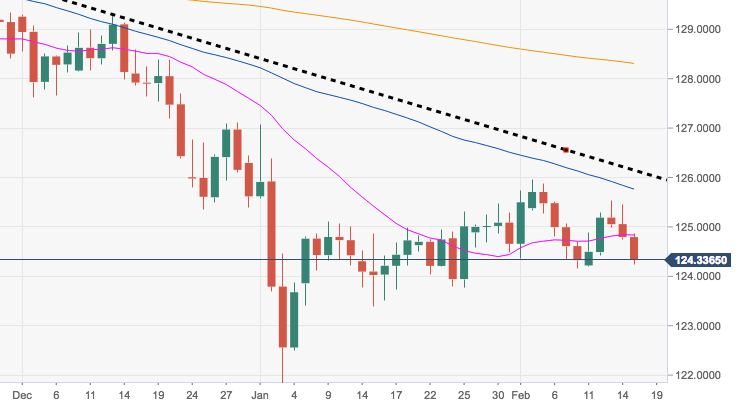

- The cross is prolonging the leg lower for another day following the recent rejection from weekly peaks in the mid-125.00s.

- The bearish outlook remains well in place as long as EUR/JPY trades below the short-term resistance line, today at 126.14, and YTD peaks in the 126.00 neighbourhood.

- The ongoing selling mood carries the potential to drag the cross to, initially, monthly lows near 124.20.

EUR/JPY daily chart

EUR/JPY

Overview:

Today Last Price: 124.32

Today Daily change: 61 pips

Today Daily change %: -0.38%

Today Daily Open: 124.79

Trends:

Daily SMA20: 124.86

Daily SMA50: 125.58

Daily SMA100: 127.36

Daily SMA200: 128.34

Levels:

Previous Daily High: 125.46

Previous Daily Low: 124.74

Previous Weekly High: 125.96

Previous Weekly Low: 124.16

Previous Monthly High: 127.07

Previous Monthly Low: 118.84

Daily Fibonacci 38.2%: 125.02

Daily Fibonacci 61.8%: 125.19

Daily Pivot Point S1: 124.54

Daily Pivot Point S2: 124.28

Daily Pivot Point S3: 123.82

Daily Pivot Point R1: 125.26

Daily Pivot Point R2: 125.72

Daily Pivot Point R3: 125.97