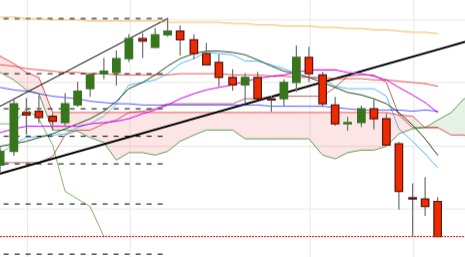

- The leg lower around the cross is picking up extra pace today, opening the door to a visit to the 125.00 level in the near term. If cleared on a sustainable basis, EUR/JPY could re-visit YTD lows in the 124.60 region.

- EUR/JPY has been dropping almost uninterruptedly since mid-July peaks in the 132.00 neighbourhood amidst the persistent selling mood hitting the single currency and a risk-off sentiment benefiting the Japanese Yen.

- The current decline has accelerated after the cross broke below the key support at 129.00 the figure in early August, which has now become a critical resistance area.

- The current oversold condition allows for a squeeze higher in the near term, although the bearish view appears unchanged as long as 129.00 caps ahead of June’s tops in the 130.40 band.

EUR/JPY daily chart

Daily high: 126.39

Daily low: 125.14

Support Levels

S1: 125.59

S2: 125.09

S3: 124.38

Resistance Levels

R1: 126.80

R2: 127.51

R3: 128.01