- EUR/JPY’s daily upside falters near the 132.50 level.

- Risk aversion props up the demand for the Japanese yen.

- Volatility tracked by the VIX index climbs to 2-day highs.

Following a move to the 132.50 region during early trade, EUR/JPY has come under some moderate selling pressure and now returns to the sub-132.00 zne.

EUR/JPY gives away gains on risk aversion

Sellers appear to have returned to EUR/JPY, dragging it to the 132.00 area on the back of the pick-up in the risk aversion mood, which in turn gives extra legs to the buying pressure in the Japanese safe haven.

Collaborating with the latter, volatility remains on the rise and lifts the VIX index (aka “the panic index”) to new 2-month peaks near the 20.0 mark.

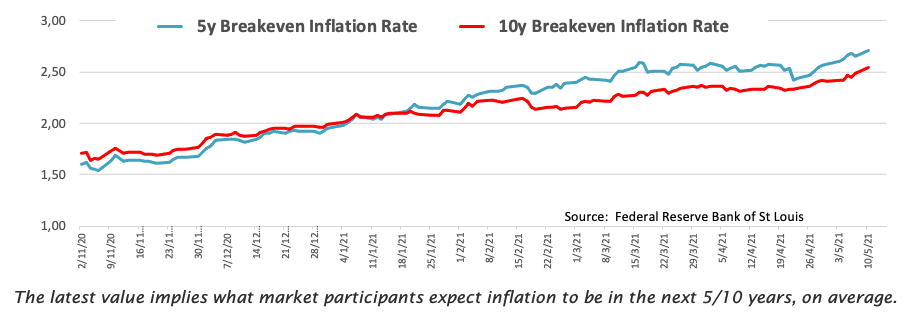

In fact, market chatter around the re-emergence of inflation fears seems to be behind the rebound in the risk aversion and the consequent demand for the Japanese currency, hence putting EUR/JPY under renewed downside pressure, with the increase in volatility just tagging along.

Data wise on Tuesday, the ZEW survey for the month of May showed the Economic Sentiment in both the Euroland and Germany improved further. In japan, the Household Spending expanded 7.2% in March, while the JGB 10-year auction came up at 0.070% (from 0.123%).

EUR/JPY relevant levels

So far, the cross is losing 0.18% at 132.26 and a surpass of 132.52 (2021 high May 10) would pave the way for a test of 133.00 (psychological hurdle) and then 133.13 (monthly high Sep.21 2018). On the flip side, immediate contention is located at 130.98 (weekly/monthly low May 5) seconded by 130.13 (50-day SMA) and finally 129.58 (weekly low Apr.23).