The euro zone is suffering from weakness, but is it already priced into the value of the euro? And in the US, what does the JOLTS data tell us about a rate hike in the US?

Here is what the team at CIBC sees for this week:

Here is their view, courtesy of eFXnews:

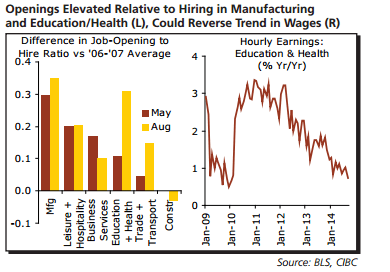

USD: We’ve previously noted that job openings have surged, yet the hire rate was still lagging. If more of the openings were filled, we would be close to the Fed’s long-run projection for the unemployment rate. Back then, hiring lags appeared to be widespread by sector.

But now, two areas have emerged where this trend is most prevalent”” manufacturing and education/health. How could that play out? If filled, those vacancies could indicate even sharper employment growth and a drop in the jobless rate, as we previously forecast. But if those jobs remain unfilled, it could also point to skills shortages and sharper wage growth””particularly important as wages in education/ health are currently depressing the overall fi gure. Either way, rate hikes by the Fed could look a little closer, keeping the greenback well supported.

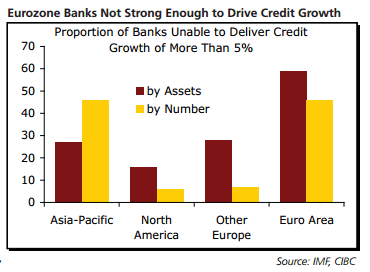

EUR: The Eurozone economy is on the rocks again, this week with German industrial production figures falling short of expectations. The difficult task the ECB faces in trying to stimulate the economy was also highlighted by the IMF. While a weaker euro should help, it is harder to think that bank lending will be spurred much by new policies coming into effect.

As IMF research shows, continued weakness in the fi nancial sector means that banks accounting for nearly 60% of assets wouldn’t be able to meet regulatory requirements and deliver credit growth of 5%. Although a lot of bad news is already priced into the euro, further sluggishness would certainly prevent much of a rebound both in terms of economic growth and the currency.

For lots more FX trades from Credit Agricole and other major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.