- The Swedish currency now regains some ground near 10.5700.

- Swedish CPI came in below estimates in February.

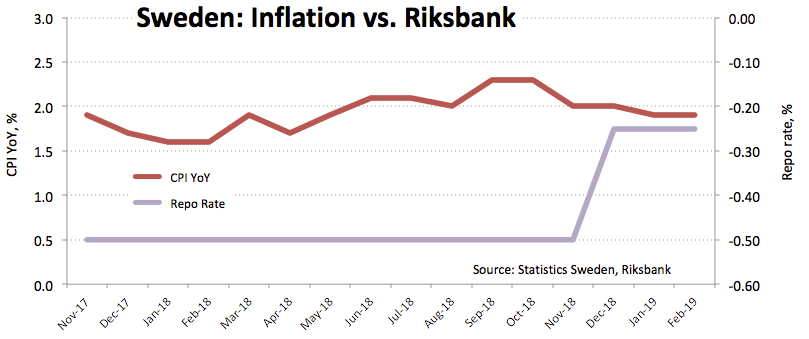

- Riksbank could now push back its rate hike projections.

Following a positive start of the week, the Swedish Krona has now resumed the downside and pushed EUR/SEK to fresh daily highs around 10.5900, where it has lost some momentum.

EUR/SEK moved higher post-CPI

After bottoming out in the vicinity of the 21-day SMA around 10.5350 during early trade, the cross regained some composure after Swedish inflation figures disappointed expectations during last month.

In fact, consumer prices gauged by the CPI rose at a monthly 0.7% and 1.9% from a year earlier. Additionally, prices tracked by the CPIF (CPI at constant interest rates) rose 0.7% inter-month and 1.9% YoY.

In the meantime, SEK is expected to remain under pressure in the next months, mainly in response to the lack of traction in domestic inflation, stagnant house prices and the renewed dovish stance from the ECB, which the Riksbank follows closely.

What to look for around SEK

Fundamentals in the Scandinavian economy remain healthy, although the projected global (and particularly the EMU) slowdown is expected to have its say on the performance of the domestic economy in the next months. If we add the recent forecasts for lower GDP, the outlook on the Krona appears cloudy, to say the least. In addition, SEK is also facing extra headwinds as market participants consider it a funding currency when comes to carry trade. Additionally, concerns over the global slowdown and the softer stance from the ECB could encourage the Riksbank to remain ‘lower for longer’, in spite of recent comments by board members suggesting a rate hike this year still remains well on the table.

EUR/SEK levels to consider

As of writing the cross is up 0.18% at 10.5695 and a break above 10.6314 (2019 high Feb.21) would open the door to 10.6476 (2019 high Mar.8) and finally 10.6929 (high May 4 2018). On the flip side, initial contention emerges at 10.5339 (21-day SMA) seconded by 10.4651 (low Feb.21) and then 10.4036 (low Feb.13).