- EUR/SEK bounces off lows near 10.0000 on Wednesday.

- The Riksbank left the repo rate unchanged at 0.00%.

- The central bank reinforces its accommodative stance for longer.

The Swedish krona gives away initial gains and EUR/SEK now gyrates around the middle of the daily range near 10.0800.

EUR/SEK looks supported near 10.0000

EUR/SEK now alternates gains with losses after a brief test of lows near the psychological 10.0000 neighbourhood following the Riksbank event.

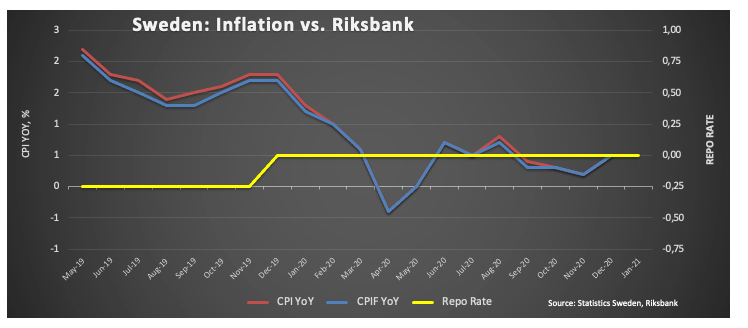

Indeed, SEK gained extra steam after the Nordic central bank left the repo rate unchanged at its monetary policy meeting, matching the broad consensus. The Riksbank stressed the resilience of the Scandinavian economy during the second wave of the coronavirus pandemic and sees further developments highly dependent on the progress of the vaccine rollout.

The central bank reiterated that the economy still needs extensive policy support, hinting at the idea that interest rates will remain at current levels for a long period (Q1 2024?). In addition, the asset purchase programme remained unchanged at SEK 700 billion.

The Riksbank, however, revised up its forecast for the GDP this year and now expects the economy to expand 3.0% (from 2.6%). Regarding inflation, the bank now sees the CPI rising 1.3% (from 0.8%) in 2021 and 1.3% (from 1.2%) in 2022.

EUR/SEK levels to consider

At the moment, the pair is losing 0.03% at 10.0775 and faces the next support at 10.0409 (monthly low Feb.10) seconded by 10.0113 (2021 low Jan.4) and finally 10.0000 (psychological level). On the upside, a move above 10.1254 (55-day SMA) would target 10.1889 (2021 high Feb.1) en route to 10.2224 (100-day SMA).