- EUR/SEK drops below 10.64, or multi-day lows.

- Sweden CPI surprised to the upside in May.

- Earlier in the week, Swedish jobless rate came in at 6.6%.

The Swedish Krona is now rapidly appreciating vs. its European peer, forcing EUR/SEK to drop and print fresh 4-day lows in the sub-10.6400 area.

EUR/SEK lower on upbeat data

SEK regained strong buying interest after inflation figures in the Scandinavian economy came in on the strong side during last month.

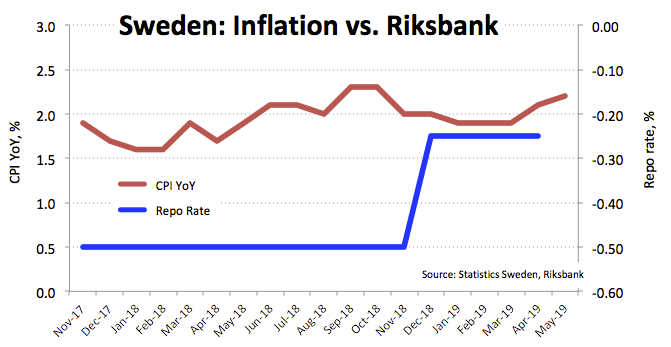

In fact, consumer prices gauged by the CPI rose 0.3% inter-month and 2.2% from a year earlier. In addition, prices tracked by the CPIF (CPI at constant interest rates) rose 0.3% on a monthly basis and 2.1% YoY.

In the meantime, the rebound from lows in the 10.5900 region recorded earlier in the month appears to have met strong resistance above weekly highs near 10.7100.

What to look for around SEK

The Krona has given away part of recent gains to the 10.5900 area vs. the shared currency. Today’s higher-than-expected inflation figures add to the probable case of a rate hike by the Riksbank later in the year. However, this view has become some sort of a long-shot amidst the recent shift from the majority of G10 central banks to a more accommodative message, particularly from the ECB, which the Riksbank monitors closely.

EUR/SEK levels to consider

As of writing the cross is losing 0.51% at 10.6374 and faces the next support at 10.6356 (low Jun.14) seconded by 10.6116 (55-day SMA) and finally 10.5889 (low Jun.6). On the flip side, a break above 10.7167 (high Jun.12) would aim for 10.8008 (high May 21) and then 10.8498 (2019 high May 13).