- The Krona gathers traction and appreciates to 10.55 area vs. euro.

- Riksbank’s Skingsley said a rate hike this year is on the table.

- Sweden Services PMI came in above estimates in February.

The decline in the Swedish Krona seems to be taking a breather on Tuesday and is now forcing EUR/SEK to drop to session lows in the 10.5500 region.

EUR/SEK weaker on mixed data, hawkish Riksbank

After moving to fresh weekly highs near 10.6300 during early trade, the cross sparked a sharp correction lower after Riksbank’s Deputy Governor Cecilia Skingsley said the central bank is still planning on raising rates this year.

Furthermore, Skingsley talked down the recent poor inflation figures in the Scandinavian economy, adding that the bank could hike rates even with inflation running below the target.

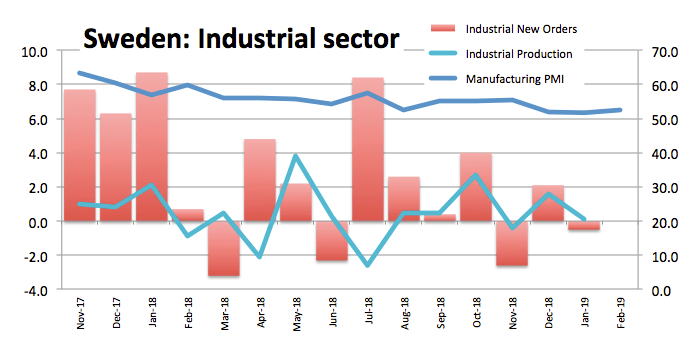

In the data space, Sweden Services PMI rose to 55.9 in February, bettering forecasts. Additionally, Industrial Production expanded at a monthly 0.1% and 1.5% on a year to January, while Industrial New Orders contracted 0.5% from a year earlier.

What to look for around SEK

Fundamentals in the Scandinavian economy remain healthy, although the projected global (and particularly the EMU) slowdown is expected to have its say on the performance of the domestic economy in the next months. If we add the recent forecasts for lower GDP, the outlook on the Krona appears cloudy, to say the least. In addition, SEK is also facing extra headwinds as market participants consider it a funding currency when comes to carry trade. Additionally, concerns over the global slowdown and the ‘wait-and-see’ mode from the ECB should prompt some caution in the Riksbank, despite minutes and comments by officials suggest a rate hike this year remains well on the table.

EUR/SEK levels to consider

As of writing the cross is losing 0.25% at 10.5628 and a break below 10.5522 (low Mar.5) would open the door to 10.5141 (21-day SMA) and then 10.4651 (low Feb.28). On the upside, the next hurdle is located at 10.6314 (2019 high Feb.21) followed by 10.6929 (high May 4 2018) and finally 10.7290 (2018 high Aug.29).