Following Draghi’\s dovishness, EUR/USD found itself back at the bottom of the range, hovering above 1.0520. What’s next?

Here is their view, courtesy of eFXnews:

In its widely anticipated decision to delay the end of QE past March, the ECB managed to cause some near-term confusion in currency markets. Even though the size of monthly purchases in the extended April-December 2017 period is going to be only 60bn euros, as opposed to the current 80bn, according to Mario Draghi that doesn’t constitute a “tapering”. So after initially rallying, the euro then ending up retreating again.

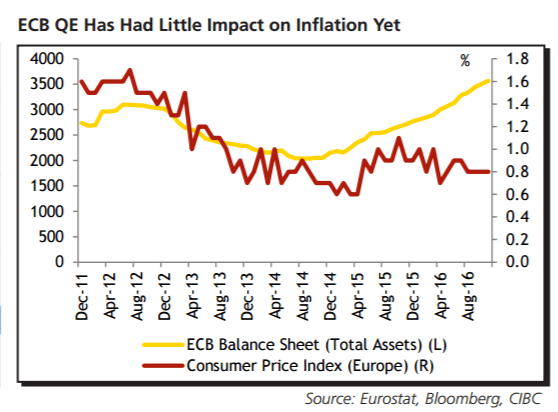

Whether this is a taper or not, the fact remains that the ECB’s QE program hasn’t been able to boost inflation, and failure to do so going forward keeps alive the very real possibility that the scheme will be extended again in the future.

Unless inflation starts to pick up, expect the euro to remain under pressure.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.