- EUR/USD extends the upside momentum beyond 1.0950.

- German, EMU Economic Sentiment came in above estimates in May.

- Chief Powell’s testimony next of significance later in the NA session.

The buying sentiment in the riskier assets is now motivating EUR/USD to prolong the optimism and climb to new 2-week peaks above 1.0950.

EUR/USD boosted by USD-weakness, data

EUR/USD keeps its march north unabated on ‘turnaround’ Tuesday on the back of the persistent and strong downside in the greenback, while positive results from the ZEW survey are also adding to the move up.

In fact, USD-sellers continue to dominate the markets and have forced the US Dollar Index to quickly retreat from tops in the mid-100.00s to the current vicinity of 99.40, or multi-day lows.

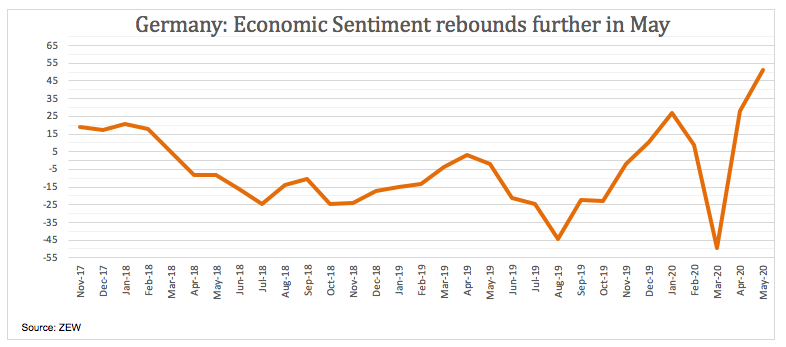

On the domestic front, the German Economic Sentiment bounced further in May, coming in above estimates at 51.0. The same indicator for the broader Euroland showed an improvement to 46.0.

Later in the NA session, Chief J.Powell will testify before the senate Banking Committee, while Housing Starts and Building Permits are of note in the US calendar.

What to look for around EUR

EUR/USD has managed to retake the 1.0900 barrier and beyond amidst a moderate selling bias in the buck and the generalized improvement in the risk appetite trends. In addition, better-than-expected results in Germany and the broader euro area have been also sustaining the strong rebound in the pair, which is now targeting the psychological barrier at 1.1000 the figure. In the meantime, the solid position of the euro area’s current account coupled with the gradual re-opening of the economy keep deeper pullbacks in the pair somewhat contained for the time being. Meanwhile, in the political scenario, the recent German court ruling against purchases of sovereign debt under the ECB’s QE programme threatens to widen the existing cracks within the euro area and could limit any serious recovery in the currency.

EUR/USD levels to watch

At the moment, the pair is gaining 0.35% at 1.0953 and a break above 1.0971 (100-day SMA) would target 1.1016 (200-day SMA) en route to 1.1019 (monthly high May 1). On the flip side, immediate contention emerges at 1.0774 (weekly low May 14) seconded by 1.0727 (monthly low Apr.24) and finally 1.0635 (2020 low Mar.23).