- EUR/USD reverses Monday’s losses and tests 1.0880.

- COVID-19 pandemic loses traction in Spain and Italy.

- Eurogroup meeting expected to agree on joint debt issuance.

The single currency has left behind Monday’s pessimism and is now pushing EUR/USD to the upper end of the range near 1.0880, or 3-day highs.

EUR/USD looks to Eurogroup event

EUR/USD regains some composure and is reversing a 6-day negative streak on Tuesday, always on the back of the improved sentiment in the risk-associated universe and renewed selling bias around the greenback.

In the meantime, all the attention is expected to be on the Eurogroup meeting due later on Tuesday, where European officials are seen discussing a joint action to help bloc’s members to fight the fallout of the coronavirus on the economy. The centre of the debate is expected to gyrate on the issuance of new debt, while the so-called “coronabonds” should also be on top of the agenda.

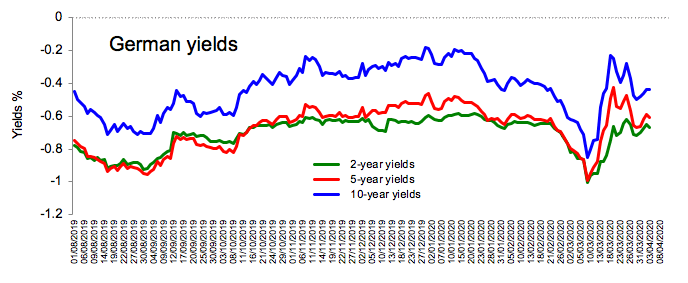

The better tone in the riskier assets has also echoed in the German fixed income markets, where yields of the key 10-year Bund are navigating daily highs around -0.37%.

In the docket, the German Industrial Production expanded 0.3% MoM during February, extending the positive trend from the start of the year and surpassing initial consensus for a 0.9% contraction. Across the Atlantic, JOLTS Job Openings and the API’s weekly report will be on the limelight.

What to look for around EUR

The single currency has regained the smile on Tuesday following the negative start of the week, as markets have improved their sentiment on the back of positive headlines from the COVID-19 pandemic, especially in Spain and Italy, where infected cases and deaths appear to have left the worst behind. On the macro view, recent better-than-expected results in fundamentals in both Germany and the broader Euroland opened the door to some respite in the prevailing downtrend, although the underlying stance still remains well on the negative side.

EUR/USD levels to watch

At the moment, the pair is gaining 0.74% at 1.0871 and a break above 1.0983 (55-day SMA) would target 1.0992 (monthly low Jan.29) en route to 1.1066 (200-day SMA). On the other hand, immediate contention emerges at 1.0768 (monthly low Apr.6) seconded by 1.0635 (2020 low Mar.20) and finally 1.0569 (monthly low Apr.10 2017).