- EUR/USD shows a bullish bias after the Fed’s statement and interest rate.

- The pair is still locked in the sideways channel.

- The risk-off sentiment continues to weigh on the pair.

The daily analysis for EUR/USD pair remains neutral to bullish after the price picked momentum on a dovish Fed’s stance. As a result, the EUR/USD pair on Tuesday and Wednesday traded as if it were a weekend. However, this is not surprising since 3 out of 5 working days pass with minimal volatility in the last weeks, and the concept of a trend has long been absent for the EUR/USD pair.

–Are you interested to learn more about automated trading? Check our detailed guide-

By and large, in recent weeks, the pair has been squeezed in a 100-point sideways channel, so all traders’ hopes were reduced to the Fed meeting.

We will not discuss the results of the meeting and the market reaction to them now. Firstly, due to the fact that it takes a little time for the markets to fully understand and digest all the information received and only then, with a cold head, to draw conclusions. Secondly, whatever Jerome Powell said after the Fed meeting, it will not change the overall picture of the state of affairs.

Recall that after the last meeting of the Fed, the pair fell by 250 points. Although, from our point of view, nothing was said beyond the expectations. For a long time there has been no talk about any specific actions by the FRS. Moreover, most likely, by the end of the year, the Fed Reserve will not decide on any changes in monetary policy.

Consequently, markets will only be able to react to what Jerome Powell says. However, Powell has made numerous speeches over the past 6 weeks and made it clear that no changes to the QE program should be expected in the coming months.

Moreover, in the United States, there is now an increase in the number of cases of coronavirus. So, a new wave of a pandemic may begin across the ocean. If so, the American economy may again begin to slow down its recovery, and it will be possible to forget about curtailing the QE program for a long time. Thus, whatever the final reaction to the Fed meeting, other global factors continue to have a greater impact on the currency pair.

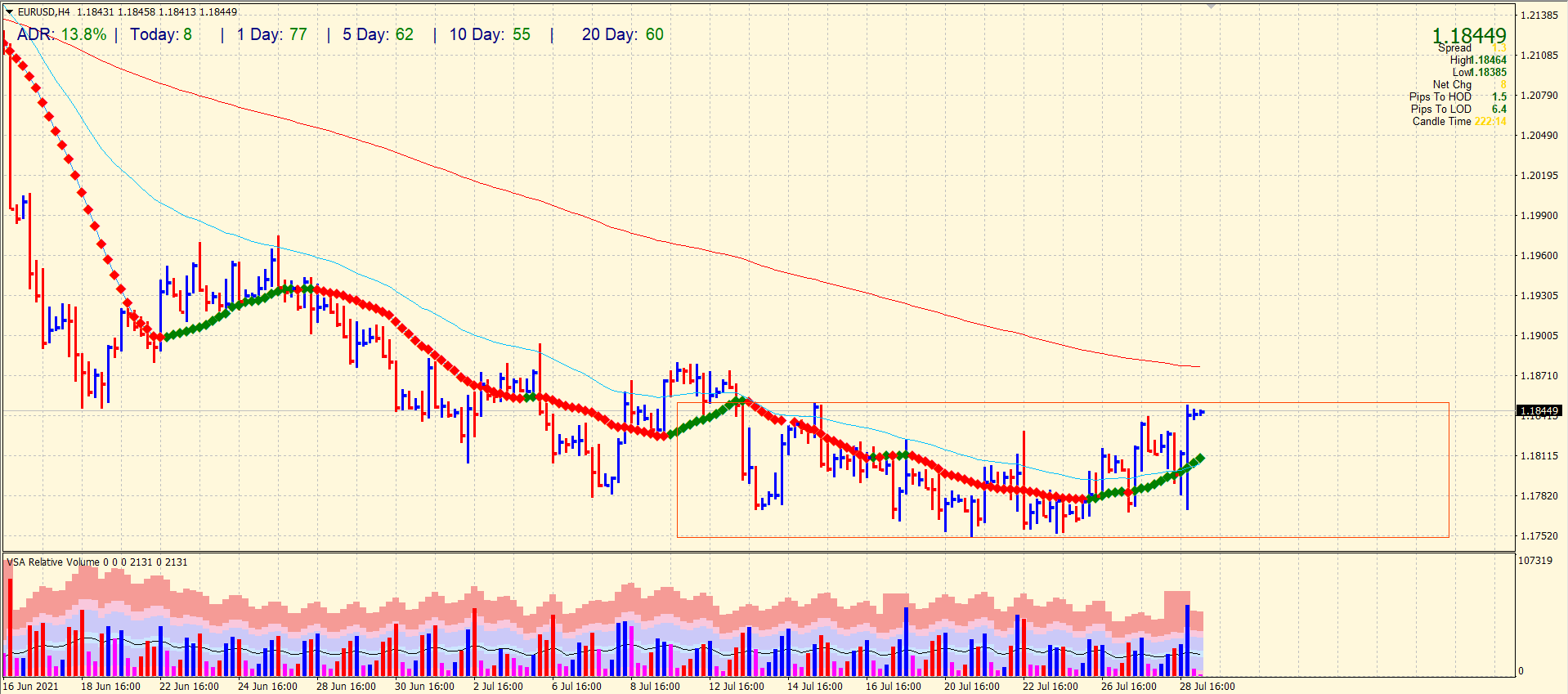

EUR/USD technical analysis: Bullish breakout confirmation?

The 4-hour chart shows a widespread up bar with ultra-high volume. It means that we got a bullish breakout. The volume is now bullish as it is rising with the price rise. Now, the price may absorb the ultra-high volume by retracing a little towards the 20-period SMA.

–Are you interested to learn more about forex signals? Check our detailed guide-

However, the price is still locked within the sideways channel and is still below the 20-period SMA at 1.1876. Hence, this breakout is not yet decisive. Nevertheless, the pair can see selling pressure on the way if it continues to stay below the 200-period SMA.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.