The EUR/USD analysis seems undecided in the short term. The traders are waiting for the US retail sales data to find fresh impetus. So, it remains to see what will really happen later today as the pressure remains high.

-If you are interested in forex day trading then have a read of our guide to getting started-

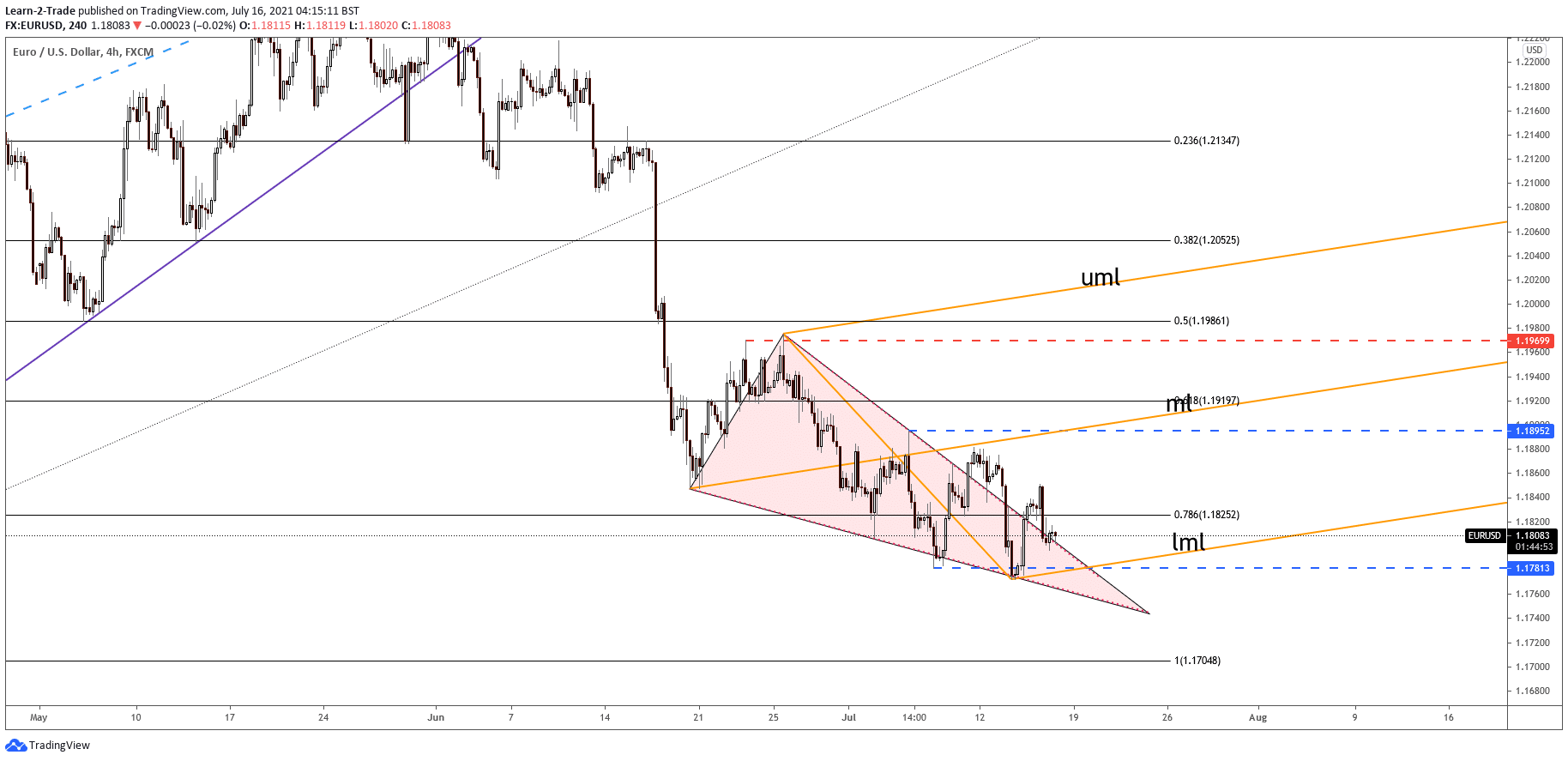

The pair has escaped once again from a Falling Wedge pattern, but it’s premature to talk about a potential upwards movement. The outlook is still bearish. So, the EUR/USD pair could drop anytime again. In addition, the US Retail Sales and Core Retail Sales data could shake the markets today. Hence, you should be careful as the volatility could trigger after the data release.

The Euro-zone Trade Balance, Final CPI and Final Core CPI could bring life to this pair in the European session. However, the pair will resume its decline if the US Dollar Index resumes its upwards movement. The DXY is located within an uptrend channel in a Rising Wedge pattern, maintaining a bullish bias.

EUR/USD price technical analysis: Can bulls roar again?

EUR/USD is located at 1.1808 under the 78.6% (1.1825) level. It has dropped to retest the broken Falling Wedge’s resistance. Technically, it could still rise in the short term as long as it stays above the lower median line (LML) and beyond the 1.1781 level.

Personally, I would like to see a minor range here before the price jumps higher. Then, a false breakdown with great separation through the mentioned support levels or a major bullish engulfing could bring a new buying opportunity.

-Are you looking for automated trading? Check our detailed guide-

Also, jumping above 1.1850 yesterday’s high could indicate potential growth in the short term. On the other hand, making a valid breakdown through the lower median line (LML) could really announce a larger decline.

The 100% Fibonacci line, 1.1704, is seen as a potential downside target if the pair drops further. The EUR/USD pair could be moved by fundamentals today, so you should keep an eye on the economic calendar.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.