- EUR/USD traders have not yet positioned after the German elections.

- A mildly better risk tone keeps the dollar under pressure.

- Lack of news about Evergrande and China’s ban on all cryptocurrencies may provide some boost to the US dollar.

The EUR/USD price analysis shows a slightly positive picture as the German elections could not weigh heavily on the pair.

While markets are refraining from new bets on the major currency pair after the German elections and before the new EU intervention, the EUR/USD pair is trying to rebound moderately from daily lows but is still within trading ranges on Monday.

-Are you looking for automated trading? Check our detailed guide-

As risk sentiment appears to be holding back dollar bulls in early Europe, markets are also awaiting US durable goods order dates. The first week of the new year saw investor optimism fueled by Chinese Evergrande and an optimistic outlook for US infrastructure. Fed Chairman Powell’s remarks and the NFP will be the major events that may shape sentiment in the current week.

Due to a lower risk appetite, a comment from the People’s Bank of China (PBoC) on illegal digital currencies and renewed concerns about Everngrandes defaulting after the interest period has expired supports the dollar.

The spokesperson for the House of Representatives, Nancy Pelosi, announced that the infrastructure bill will be voted on Thursday, despite her confidence in a $1 trillion infrastructure stimulus package.

In the aftermath of the German Bundestag elections on Sunday, traders have refrained from positioning themselves in the common currency. Instead, for the first time since 2005, they have called for a “clear mandate” for government and the end of 16 years of conservative rule with Angela Merkel.

As a way to estimate the trade situation, investors will be looking at the speech by European Central Bank President Christine Lagarde and consumer goods order data in the US.

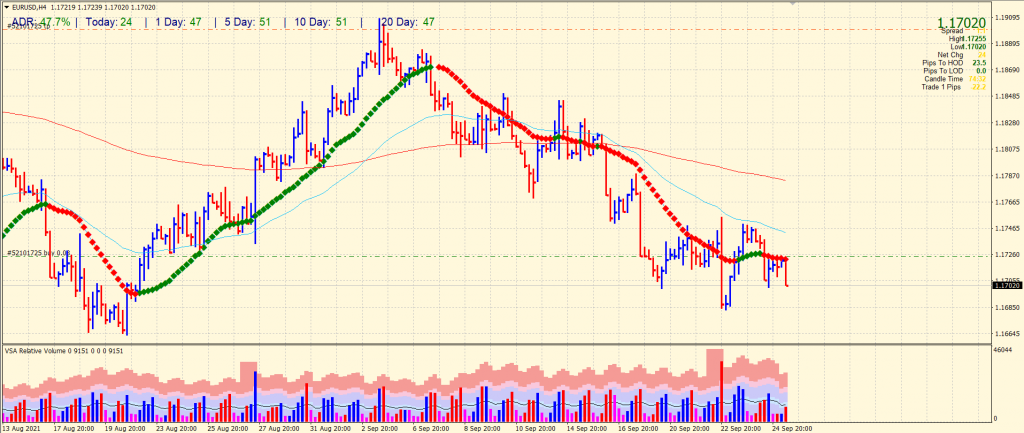

EUR/USD price technical analysis: 1.1700 to hold

The EUR/USD price managed to find some support near the 1.1700 area and gained around 20 pips. However, the price is still under bearish pressure and may not find acceptance above the 1.1700 area. Thus, any rally will be capped by the 1.1750 level. Overall, the scenario remains the same as last week.

-If you are interested in forex day trading then have a read of our guide to getting started-

The pair has completed a 47% average daily range so far, indicating expected European session volatility. However, the volume data still supports the upside.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.