- The US dollar is rising vs a broad basket of currencies.

- Cases are rising on both sides of the Atlantic.

- Traders waiting for the ECB meeting, as the overall sentiment remains bullish.

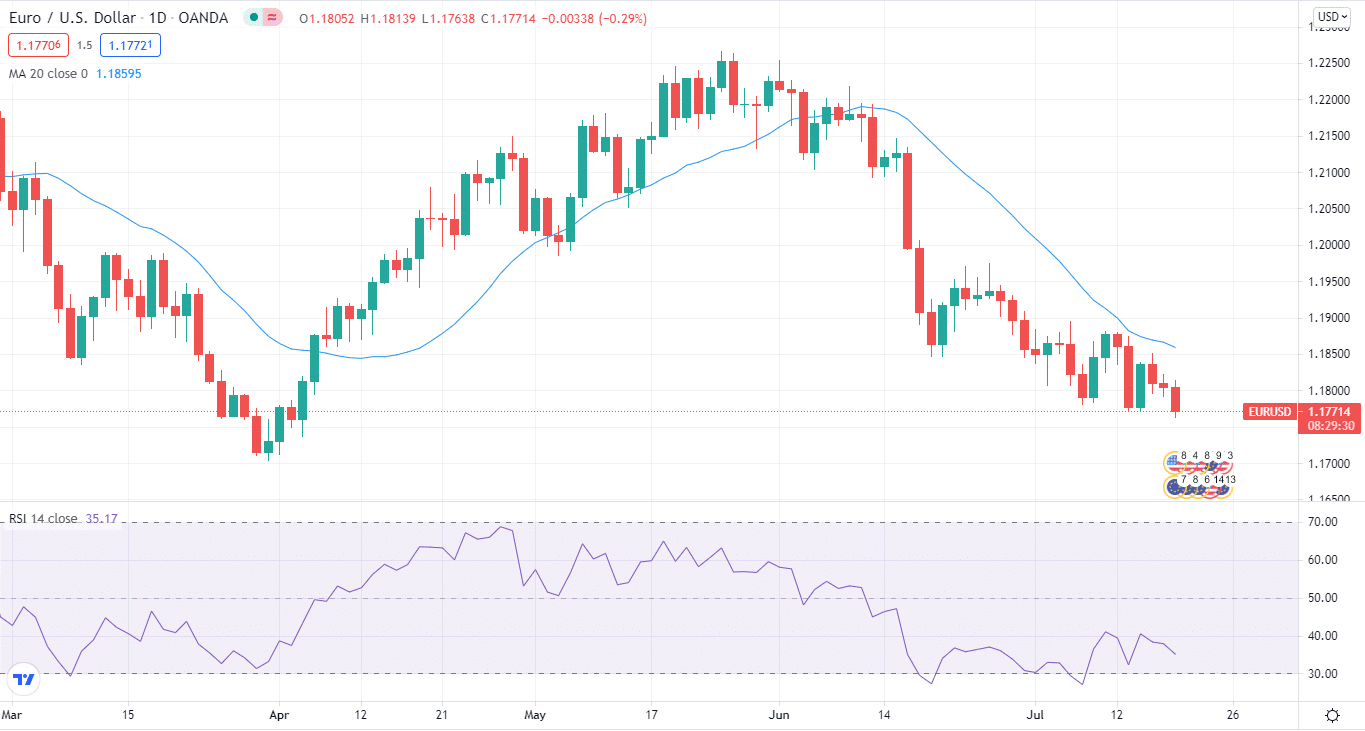

On Monday, July 19, the EUR/USD analysis started the week testing the support level at 1.1800. The Euro remains red for the third day in a row and falls below the 1.18 mark.

–Are you interested to learn about forex robots? Check our detailed guide-

Cases are on the rise on both sides of the Atlantic, with the unvaccinated bearing the brunt of the burden. In addition, travel and activity limitations in Europe may weigh on the fledgling recovery and summer vacations.

A key point to add is that the ECB Interest Rate Decision on July 22 is the week’s biggest event for EUR/USD traders. Therefore, the interest rate will remain steady, and traders will pay close attention to ECB statements.

Recent inflation figures showed that inflation remained under control, implying that the ECB will likely remain very dovish. However, rising infections might bolster the doves “” possibly leading to an extension of the bond-buying scheme. In addition, more euros printed may put pressure on the shared currency.

While the United States is also experiencing an increase in COVID cases, the impact on the currency may be different because the dollar is a safe-haven currency. In times of tumult, the greenback gains from inflows.

Rising US inflation is another aspect causing investors to pause. The Federal Reserve is keenly monitoring these surveys to see if inflation has taken hold in consumers’ thoughts – something that goes beyond a temporary increase in costs due to the rapid reopening of the US.

–Are you interested to learn more about scalping brokers? Check our detailed guide-

The dollar may gain if the Fed moves closer to winding down its bond-buying program.

EUR/USD technical analysis: Key levels in action

EUR/USD is currently attempting to settle below the 1.1750 support level.

If the EUR/USD manages to fall below this level, it will head towards the support level at the recent lows of 1.1700.

A break below the 1.1720 support level will lead to a test of the next support level, which is positioned at 1.1690.

On the upside, the nearest resistance level for the EUR/USD is at 1.1830. If the EUR/USD breaks through this level, it will head for the next resistance at the 20 EMA at 1.1860. If the EUR/USD manages to break over the resistance at 1.1860, it will gain additional upward momentum and go towards the resistance at 1.1880.

Overall, the trend remains bearish for now.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.