- EUR/USD fell below the March 21 lows of 1.1700 as Greenback rallied to 5-month highs.

- Initial jobless claims data came better than expected, providing additional support to the US dollar.

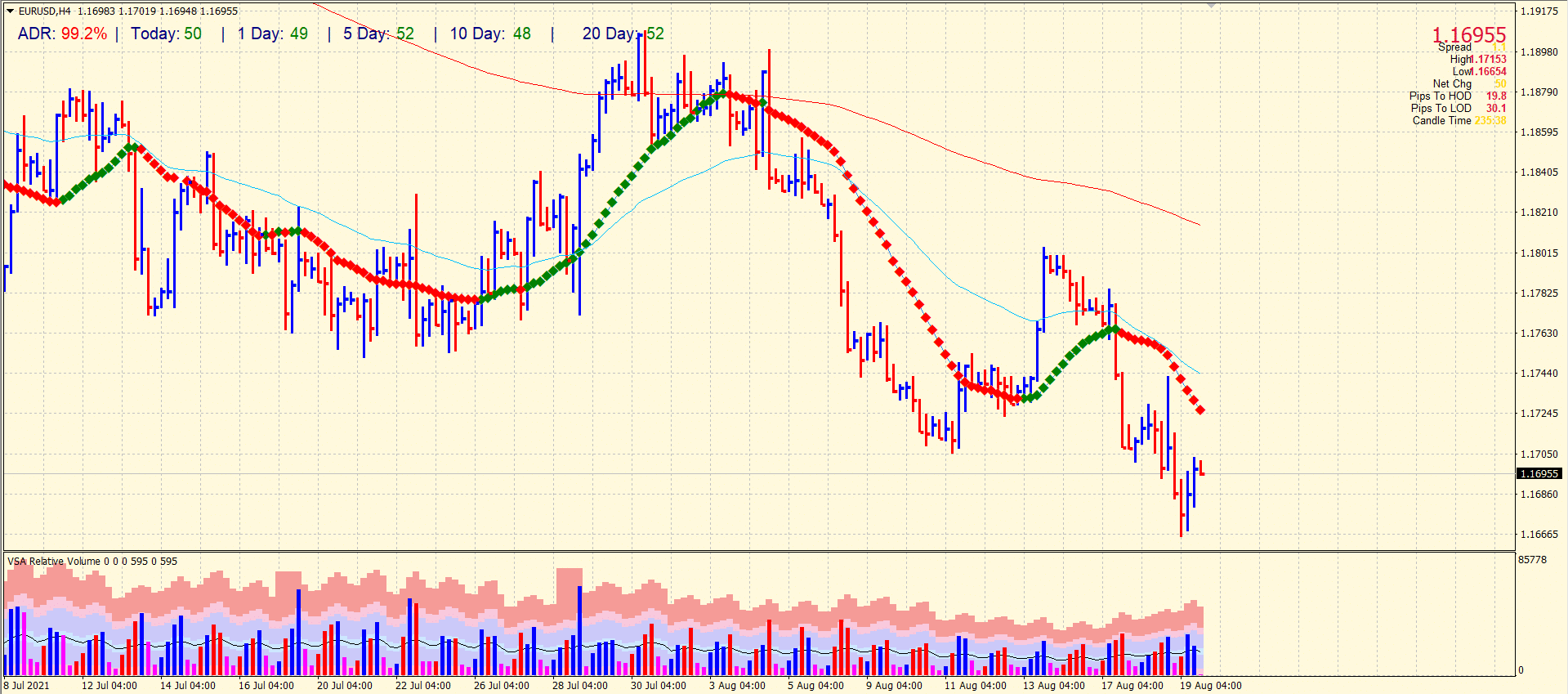

- Technically, the pair is now consolidating losses after a mild recovery.

The EUR/USD price analysis suggests a broader bearish perspective despite the recent 40-pip recovery. The FOMC minutes keep weighing.

The EUR/USD is trading at 1.167, down 0.10, at the time of writing on Thursday.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

While risks to the economy remain, the US bond-buying program may slow down soon, as the FOMC meeting minutes released yesterday demonstrate. Chairman Powell is set to announce a change in Fed thinking of the Jackson Hole Symposium, Aug. 26-28. The latest consolidated economic forecast will be announced at the FOMC meeting in September as one narrowing announcement gets underway.

After the USD rallied to a five-month high, the EUR/USD fell below strong support at 1.1700 and recamped at levels last seen early in November. Then, on a selling spree in Asian markets, the March 2021 low of 1.1704 and the 38.2% Fibonacci retracement level at 1.1695 fell, putting the November 04, 2020 low of 1.1603 at risk.

Initial US Unemployment Claims data was released a while ago. According to a US Department of Labor (DOL) report published on Thursday, 348,000 initial claims for unemployment benefits were made in the US during the week ending August 14. In contrast to market expectations of 363,000, this print came in better than the previous print of 377,000 (upped from 375,000).

What to look around for Euro?

The region has experienced an asymmetric economic recovery. Inflation indicators continue to grow steadily. Coronavirus delta variant development and vaccination rates are key indicators to determine the market sentiment. It is likely that there will be a political eruption around the EU recovery fund. This scenario could be boosted by the September elections in Germany. Following the pandemic, investors may turn to European stocks, giving the Euro more oxygen.

EUR/USD technical analysis: Bearish bias sustains around 1.1700

The EUR/USD found some traction near the 1.1660 area after posting fresh YTD lows. The pair has jumped back near the 1.1700 handle. The small recovery wave has been carried by up bars with very high volume, which indicates that the pair has a tendency to recover further. The pair may find resistance around 1.1700 level ahead of 1.1730 near the 20-period SMA on the 4-hour chart.

–Are you interested to learn more about forex signals? Check our detailed guide-

On the downside, YTD lows at 1.1660 can provide some support ahead of November 04 lows at 1.1603. The pair remains under dark clouds under 1.1730 (20-period SMA).

The pair had done almost 100% average daily range. It means that the odds of making any trendy move are quite low for today. The pair may wobble around the 1.1700 area.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.