- EUR/USD has dropped off the highs, surrendering to dollar strength.

- Concerns about a patchy recovery may push the currency pair lower.

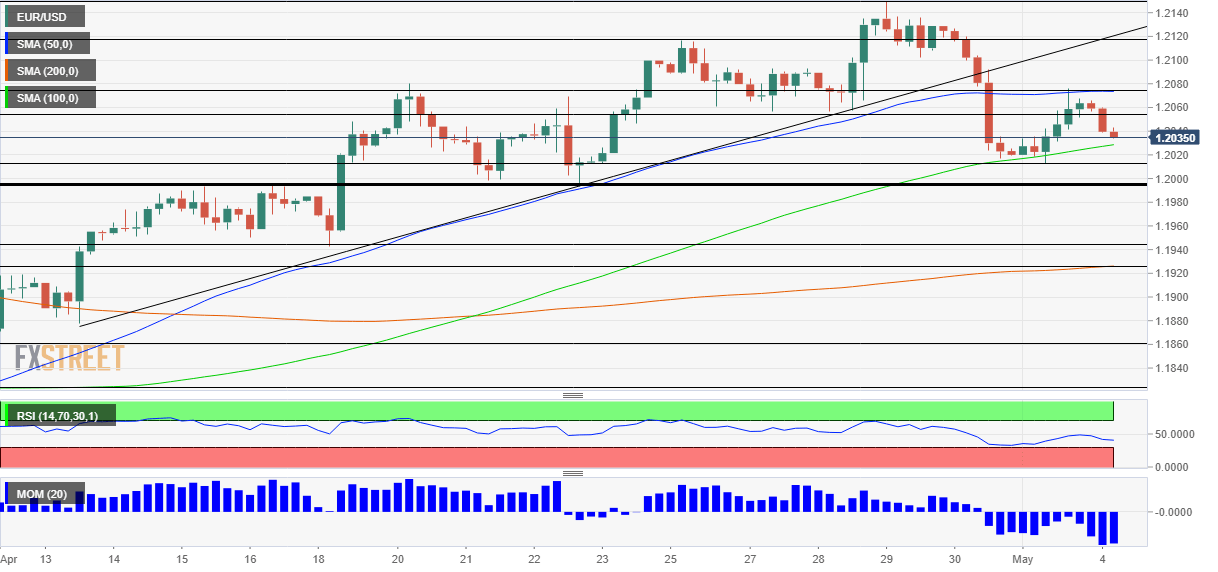

- Tuesday’s four-hour chart is showing that bears are gaining ground.

It is springtime and Europe is reopening to travelers – yet the upbeat news coming from Brussels is insufficient to help the euro recover against the resurging dollar. The old continent’s vaccination campaign is picking up speed, but that seems to already be in the price.

Instead, markets seem to focus on some sober comments from Jerome Powell, Chair of the Federal Reserve. Despite acknowledging America’s recovery, the powerful central banker characterized this upswing as “patchy” and stressed that unemployment at among those earning less is still elevated.

Another insight into an uneven recovery came from the ISM Manufacturing Purchasing Managers’ Index for April. After hitting multi-year highs in March, the forward-looking gauge fell from 64.7 to 60.7. Details of the report pointed to supply chain issues and rising prices.

The comeback from the pandemic could be too quick to handle and may require some cooling down. These worries are weighing on the market mood and pushing the safe-haven dollar higher. Will it continue?

Overall, supply bottlenecks should be resolved and so should issues related to the virus. While the world is following the pictures from India with fear, America is set to expand its vaccination scheme to adolescents – and may already contribute more doses to other countries. However, in the shorter run, various issues will likely cause jitters, and that could push the greenback higher.

EUR/USD Technical Analysis

Euro/dollar is suffering from downside momentum on the four-hour chart and remains capped by the 50 Simple Moving Average. On the other hand, it has bounced off the 100 SMA.

Support awaits at 1.2015, the weekly low, and then by 1.1990 – a double-bottom and separator of ranges. Further below 1.1945 and 1.1920 are eyed.

Some resistance is at 1.2075, the weekly high, followed by 1.2117, the late-April swing high, before 1.2150, last month’s peak.

EUR/USD Price Forecast 2021: Euro-dollar long-term bullish breakout points to 1.2750