- EUR/USD bears are looking for a downside extension into weekly demand.

- Bulls, however, could step in prior to the next downside impulse.

EUR/USD is trading better offered, licking its wounds around 1.1820, down some 0.2% on the day. EUR/USD fell from a high of 1.1853 to a fresh weekly low of 1.1812 and there could still be more to come in USD strength.

Firstly, Asian shares slid to a two-week trough on Wednesday while the greenback moved in on four-month highs as coronavirus lockdowns in Europe and potential US tax hikes hit risk appetite, leading to a flight to safety.

There was some rest bite in the US dollar in Europe on positive economic UK and EU PMIs calmed nerves.

However, despite a bullish early start on Wall Street, the greenback has recovered again and made fresh highs in New York, helped by US Treasury yields recovering from one-week lows.

At the same time, concerns about the economic impact of COVID-19 linger which has led investors to show a preference for the US currency which could be a theme that will continue for a while longer.

The US dollar can continue to strengthen further this year, as yields continue to rise by more in the US than in most other developed markets.

It boils down to the divergence of economic recoveries and the pace of the vaccine rollout between the EU and the US in particular.

The combination of significant fiscal stimulus and a successful vaccine programme means the US, in stark contrast to the EU, could be headed for a very strong recovery.

As for rates, the EU’s policymakers are singing from a different hymn sheet to that of the Fed’s.

The Fed is willing to accept higher long-term yields due to optimism about the recovery while the EU is not. The European Central Bank has already signalled it would be bringing forward bond purchases.

Meanwhile, the latest restrictions in the EU likely setback the economic every even further and investors continued to exit long euro positions.

According to the latest CFTC positioning data, EUR net longs have continued to dropped and are at their lowest since June 2020 while for the first time since early June 2020, speculators’ net positions have turned long USDs. This followed a reduction in shorts in recent weeks.

Hence, the technical outlook has soured from a long-term perspective.

EUR/USD technical analysis

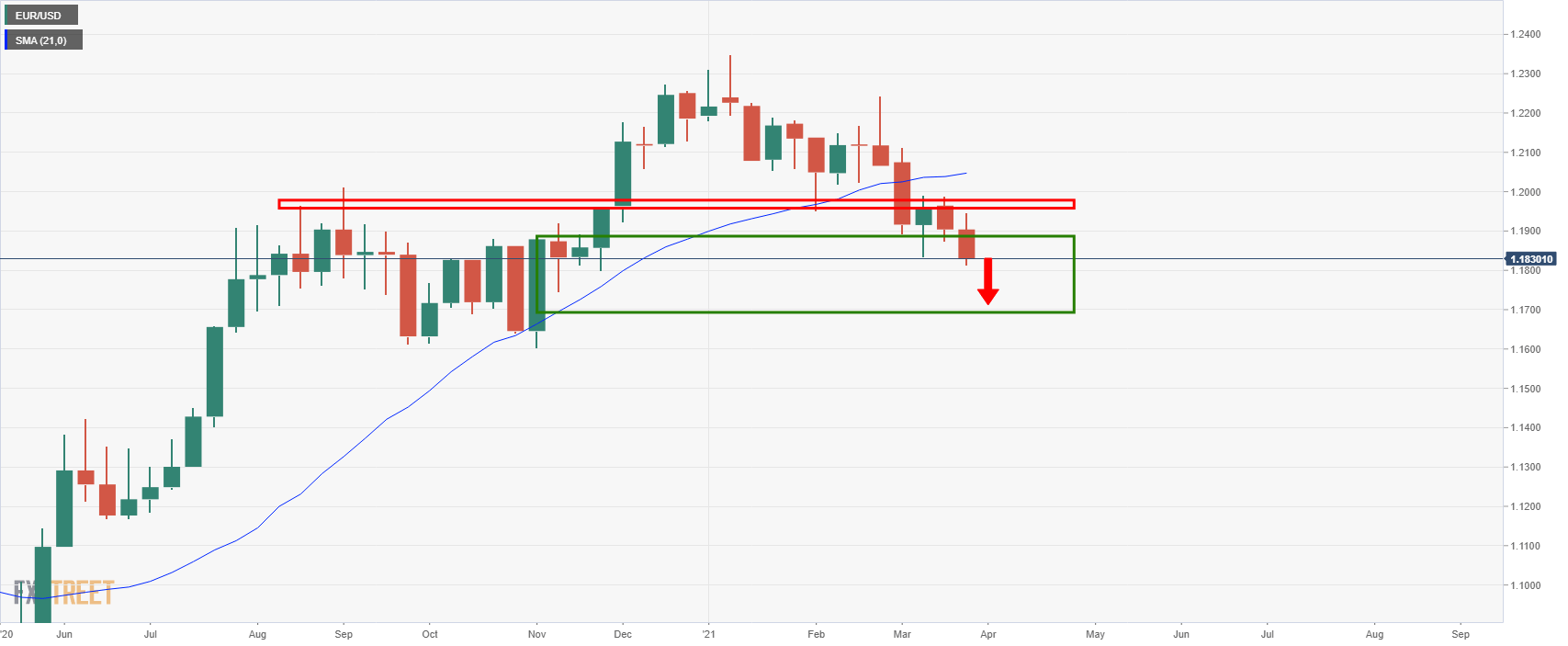

The weekly chart above shows that there is a bearish bias all the way into the demand zone.

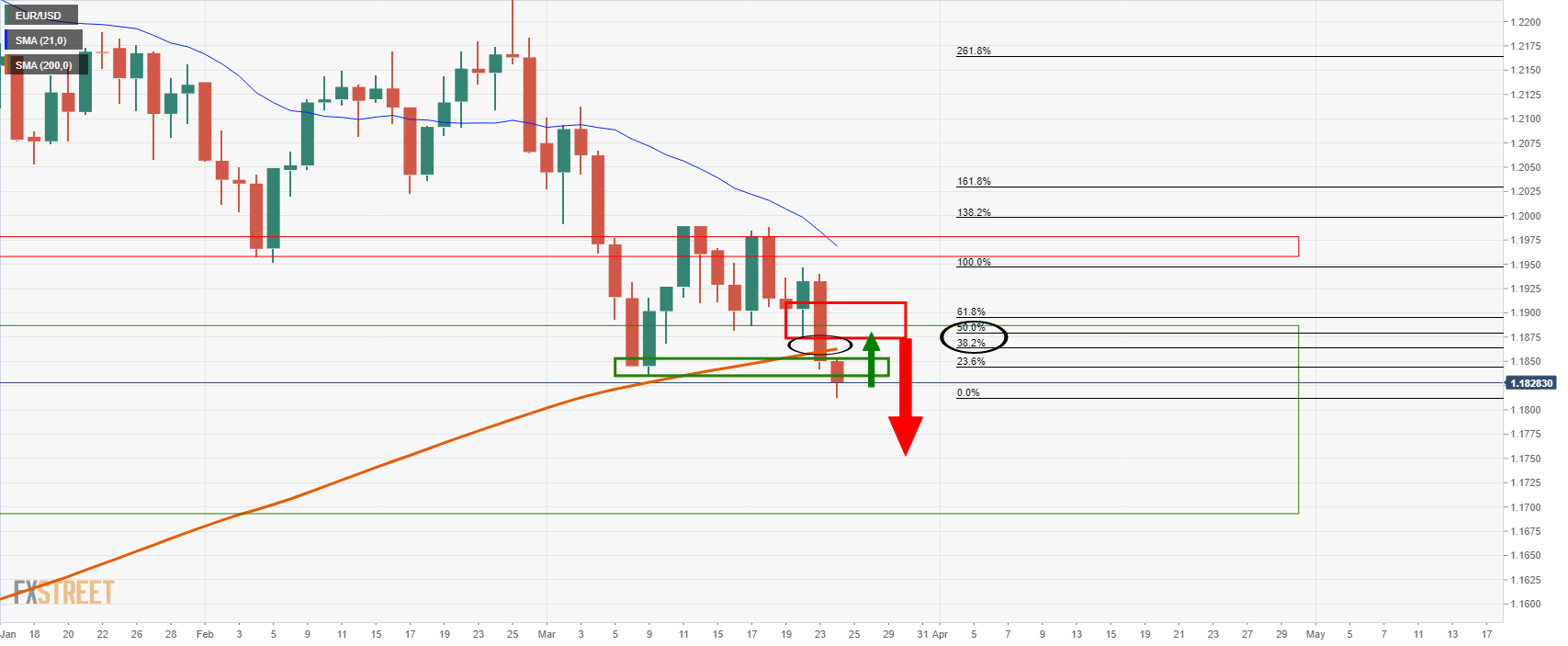

The daily chart below shows that the price closed below the 200-day SMA on Tuesday and is printing a lower low on Wednesday.

That being said, an upside correction will come in handy for the bears seeking a discount and a confluence of old support, the 200-day SMA and a 38.2% Fibonacci area could be targetted prior to the next bearish impulse.