- EUR/USD is stabilising on US dollar weakness with eyes on the vaccine roll-out.

- Politics, central banks and coronavirus are driving the fundamentals in the single currency and US dollar.

EUR/USD is currently trading at 1.2167 having travelled between a low of 1.2137 and 1.2179 on the day so far.

The single currency is higher by some 0.16% at the time of writing, lifted by some weakness in the US dollar on Tuesday following its recent rally, driven by a spike in US Treasury yields, which has appeared to run out of steam.

The dollar had hit a more than 2-1/2-year low in January after sliding for months as the US Federal Reserves’ interest rate cuts and speculation of heavy rounds of fiscal stimulus under President-elect Joe Biden.

Strong investor demand for riskier assets has sapped demand for the safe-haven US currency and enabled the single currency to each multi-week highs, the highest since April 2018.

However, expectations for a wave of spending under an incoming Joe Biden administration have pushed Treasury yields higher, with the 10-year yield reaching a 10-month high on Tuesday.

This ultimately had a reverse effect and sent the dollar higher which has now given back some ground.

Meanwhile, however, new lockdown measures across Europe to fight a second COVID-19 wave are could kick in and fears of a “double-dip recession,” in the eurozone could spark a move away from the euro.

A lot will now depend on the vaccine rollouts

The market is pricing in a successful distribution and USD shorts have subsequently crept higher last week.

meanwhile, on a spot basis, the runoff of the Georgian Senate elections has given the Democrats the casting vote allowing for speculation of a boost in deficit spending. This has pushed nominal yields higher and triggered profit-taking in short USD positions

EUR net longs drifted lower for a second week but remain largely consolidative. However, the follow-ups on the vaccine will be critical in the markets positioning over the coming weeks.

”The perception that the ECB may not have the ammunition to avoid extremely low inflation levels continues to support expectations around real interest rates and the EUR,” analysts at Rabobank argued.

EUR/USD technical analysis

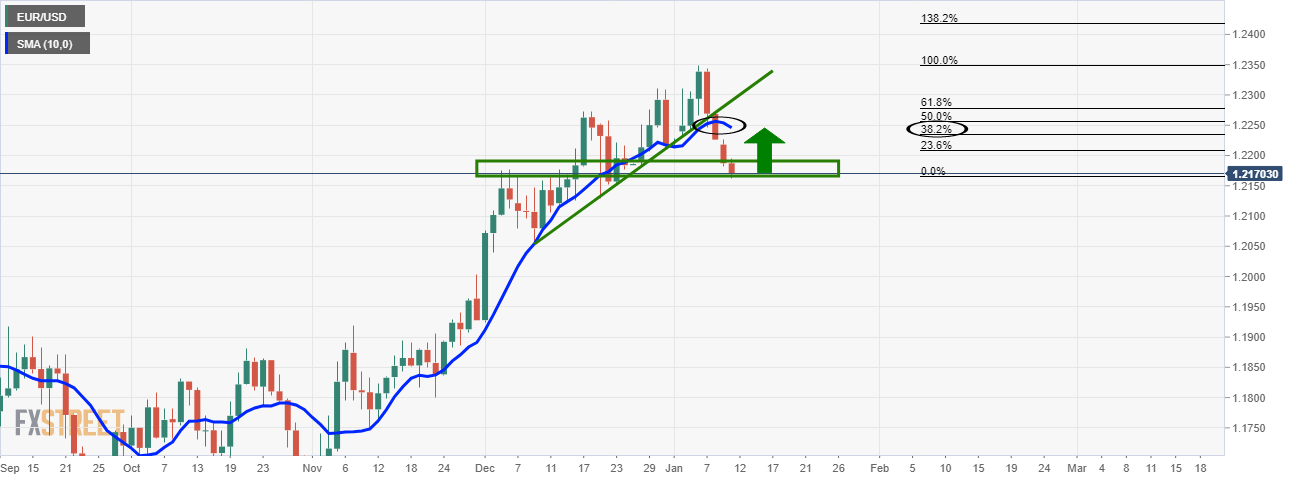

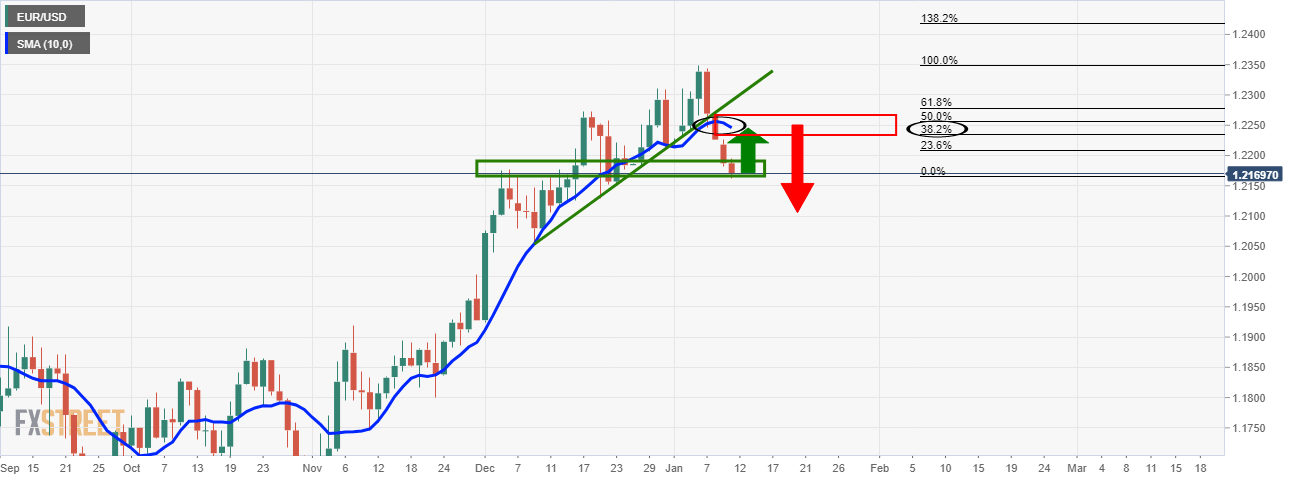

- EUR/USD Price Analysis: Bulls looking to a significant correction from daily support

As per earlier analysis from the start of the week, the price is expected to correct higher before the next leg to the downside can evolve.

As illustrated in the prior analysis and chart above, the price was expected to stall and correct.

Sticking to the analysis, the following illustrates a probable path for the euro over the coming days: