- EUR/USD has turned lower as US yields resume their gains.

- American inflation figures and a critical Treasury auction are set to dominate trading.

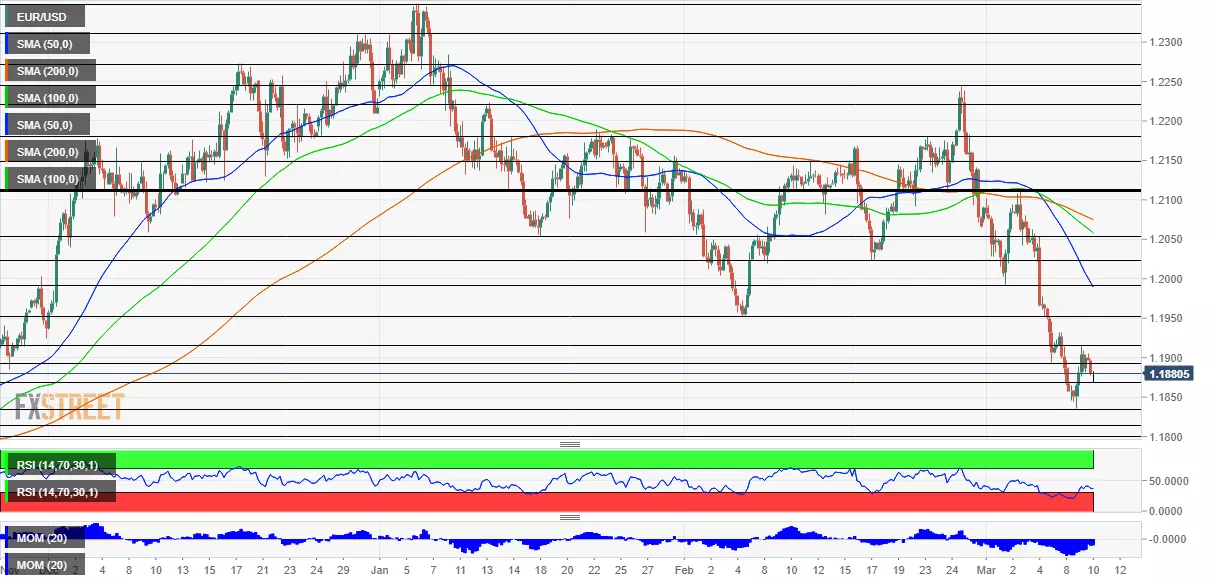

- Wednesday’s four-hour chart is pointing to additional falls.

Turnaround Tuesday? That is over now, as EUR/USD performed one of its typical dead-cat bounces and is heading to new lows. US ten-year bond yields have resumed their gains on Wednesday, allowing the dollar to gain fresh ground – and more may be in store.

That relief rally in Wall Street was partially triggered by Chinese authorities’ intervention to shore up stocks on Tuesday – a feat that did not repeat itself on Wednesday. The more cautious mood is now favoring the safe-haven dollar as tensions mount ahead of Wednesday’s heavyweight events.

First, Consumer Price Index figures for February are set to show a pick up in inflation, especially in headline prices fueled by rising oil prices. While Core CPI has likely remained in check last month, any tick to the upside may carry the greenback higher.

US CPI February Preview: A perfect storm in the making?

The more significant event in America’s auction of new ten-year Treasuries. Investors have been glued to this global benchmark as a guide for the next moves. Tuesday’s three-year offering was smooth, resulting in robust demand and pushing returns lower. However, demand for longer-term debt may be different.

At the time of writing, the ten-year yield is hovering around 1.54%, above the lows but below 1.60% which causes stocks to shiver. If investors seize on the new issuance of debt, yields could slip toward 1.50% and allow EUR/USD to resume its recovery. However, there are greater chances that the ten-year auction follows the recent seven-year one – resulting in weak demand, higher returns, and a consequent surge in the dollar.

US 10-Year Treasury Auction: Interest rates return to center stage

The bond auction is due at around 18:00 GMT, around the time that the US House of Representatives is set to approve the Senate’s version of the covid relief package. President Joe Biden will likely sign the bill into law shortly afterward, unleashing $1.9 trillion in stimulus funds. The plan has been one of the upside triggers for yields and the dollar, but its passage is fully priced in.

The old continent continues struggling with coronavirus, with Italy bearing the brunt of the recent uptick in cases. Europe’s vaccination schemes remain sluggish, especially in comparison to America’s accelerated drive. Alaska has become the first state to offer jabs to anyone aged 16 or more.

All in all, the currency pair’s downside correction may be on the verge of ending, with new lows in sight.

EUR/USD Technical Analysis

Euro/dollar is suffering from downside momentum on the four-hour chart and trades below the 50, 100 and 200 Simple Moving Averages. Moreover, the Relative Strength Index has risen above the 30 level – exiting oversold conditions.

Bears are in full control.

Support awaits at the daily low of 1.1868, followed by the 2021 trough of 1.1836. A weak cushion awaits at 1.1815, with stronger support at 1.18 – a psychologically significant level, followed by 1.1750. All were in play in late 2020.

Some resistance is at the daily high of 1.1902, followed by 1.1915, Tuesday’s high point. It is followed by 1.1950 and 1.1990.

EUR/USD Price Forecast 2021: Euro-dollar long-term bullish breakout points to 1.2750