- EUR/USD briefly tests lows in the 1.1870 region.

- The bid tone around the dollar remains well and sound.

- EMU’s Current Account results, ECB-speak next on tap.

The single currency manages to reverse the initial pessimism and now lifts EUR/USD back to the 1.1900 region.

EUR/USD risks a drop to the 200-day SMA

EUR/USD now alternates gains with losses at the beginning of the week. The pair rebounds from earlier lows in the 1.1870 zone and reclaims the 1.1900 neighbourhood following two consecutive daily pullbacks.

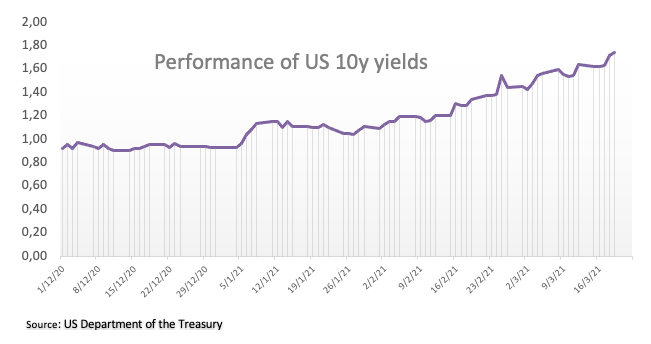

In the meantime, the buying interest surrounding the dollar stays well and sound and keeps weighing on the pair in a context still dominated by the strong recovery expected in the US economy and rising US yields (supported by prospects of higher inflation in the upcoming months).

Additionally, the poor pace of the vaccination campaign in the Old Continent continue to cloud the growth outlook for the region and adds to the offered stance in the single currency.

In the domestic docket, January’s Current Account figures are due later ahead of the speech by ECB’s Board member I.Schnabel.

Across the pond, February’s Chicago Fed National Activity Index and Existing Home Sales are due followed by speeches by Chief Powell and FOMC’s R.Quarles and M.Bowman.

What to look for around EUR

EUR/USD keeps the consolidative/bearish theme unchanged and still supported by the critical 200-day SMA near 1.1850. The persistent solid stance in the greenback has been undermining the previous constructive view in the pair in the past weeks, as market participants continue to adjust to higher US yields and the outperformance of the US economy (vs. its G10 peers). However, the steady hand from the ECB (despite some verbal concerns) in combination with the expected rebound of the economic activity in the region in the post-pandemic stage is likely to prevent a much deeper pullback in the pair.

Key events in the euro area this week: Advanced PMIs for the month of March, flash Consumer Confidence (Wednesday) – European Council meeting (Thursday and Friday).

Eminent issues on the back boiler: Potential ECB action to curb rising European yields. EUR appreciation could trigger ECB verbal intervention, especially amidst the future context of subdued inflation. Probable political effervescence around the EU Recovery Fund.

EUR/USD levels to watch

At the moment, the index is losing 0.03% at 1.1897 and faces the next support at 1.1870 (weekly low Mar.22) seconded by 1.1846 (200-day SMA) and finally 1.1835 (2021 low Mar.9). On the other hand, a breakout of 1.1989 (weekly high Mar.11) would target 1.2058 (50-say SMA) en route to 1.2113 (monthly high Mar.3).