- EUR/USD meets selling pressure and drops below 1.2100.

- German IFO Business Climate improved further in February.

- ECB’s Christine Lagarde will speak later in the session.

The single currency faces some mild selling pressure and drags EUR/USD to the 1.2090 region at the beginning of the week, just to rebound afterwards.

EUR/USD hovers around 1.2100 ahead of Lagarde

EUR/USD looks to rebound from the earlier drop to daily lows in the 1.2090 region on the back of the resumption of some buying interest in the greenback.

The move, however, appears short-lived as market participants gauge the positive results from the euro docket coupled with the usual reflation trade the firmer vaccine rollout and prospects of extra US fiscal stimulus.

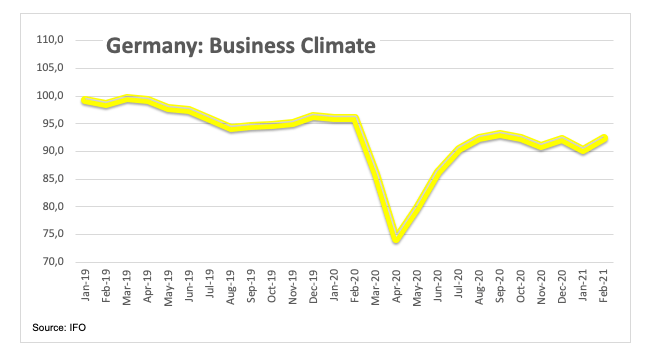

In fact, the German Business Climate tracked by the IFO survey improved to 92.4 for the current month, climbing at the same time to 4-month highs. Later in the session, the ECB’s C.Lagarde will speak on ‘Stability, Economic Coordination and Governance in the EU’.

Across the pond, the Chicago Fed National Activity Index and the Dallas Fed Manufacturing Index are all due later in the NA session along with the speech by FOMC’s M.Bowman (permanent voter, centrist).

What to look for around EUR

EUR/USD regained the 1.2100 mark and above after meeting decent support in the 1.2020 region during last week. The constructive outlook for the pair, however, is expected to remain unchanged in the longer run, always supported by the reflation/vaccine trade and hopes of a strong recovery in the region. In addition, real interest rates continue to favour the euro area vs. the US, which is also another factor supporting the EUR along with the huge, long positioning in the speculative community.

Key events in Euroland this week: ECB’s Lagarde will speak later on Monday and will participate in the G20 meeting of central bank governors and finance ministers on Friday. January’s final inflation figures (Tuesday). German final Q4 GDP results (Wednesday). European Council meeting (Thursday and Friday).

Eminent issues on the back boiler: EUR appreciation could trigger ECB verbal intervention, always on inflation issues. EU Recovery Fund. Huge long positions in the speculative community.

EUR/USD levels to watch

At the moment, the index is losing 0.03% at 1.2110 and faces the next support at 1.2023 (weekly low Feb.17) followed by 1.1999 (100-day SMA) and finally 1.1952 (2021 low Feb.5). On the other hand, a breakout of 1.2169 (weekly high Feb.16) would target 1.2173 (23.6% Fibo of the November-January rally) en route to 1.2189 (weekly high Jan.22).