- EUR/USD has been advancing as EU leaders are reportedly closer to striking a deal.

- Hopes for progress on a vaccine are keeping markets despite rising cases.

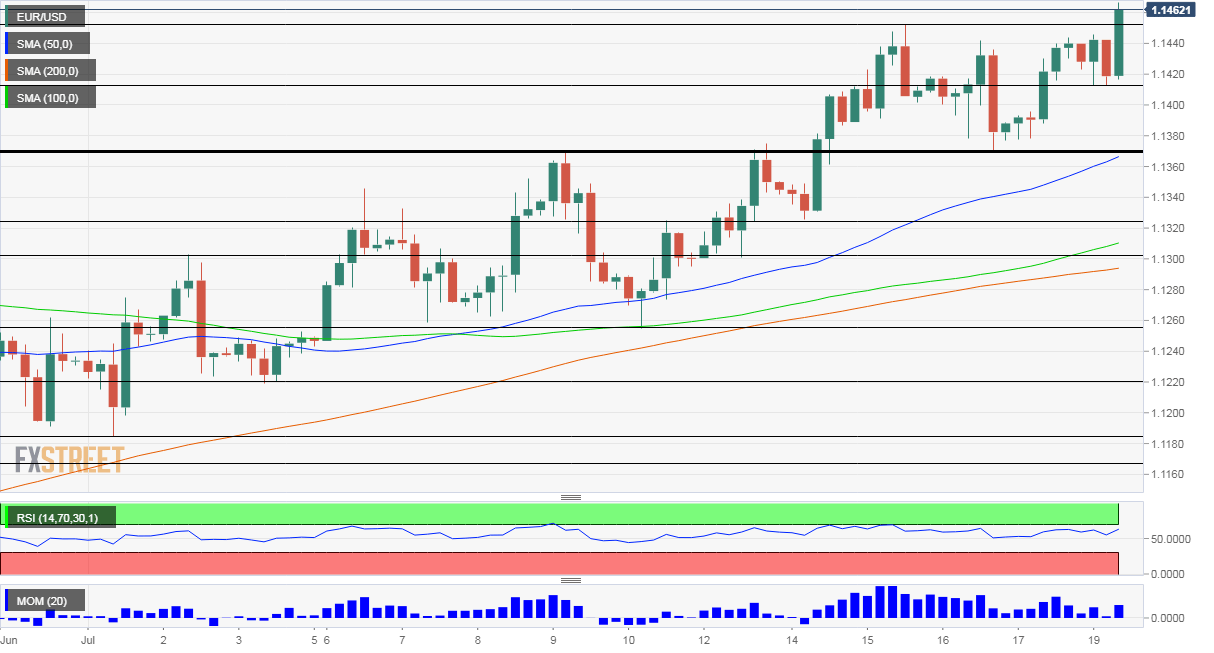

- Monday’s four-hour chart is pointing to further gains.

Turkish Bazar – Markets in the country that was rejected from entering the EU resemble negotiations between the continent’s elite. Leaders in the old continent have been extending their haggling for the fourth day, trading to sign off on a recovery fund – and they are reportedly on the verge of a bargain.

The original EU Commission plan – backed by Germany, France and most of Europe – consisted of €500 billion in mutually funded grants to the hardest-hit countries. The program was held back by the “Frugal Four” – a group of rich countries led by Mark Rutte, the Dutch Prime Minister who insisted on conditionality and lower sums.

The latest from Brussels suggest that the “frugals” are willing to accept €390 billion in grants. Is this sum enough for a recovery in the coronavirus-struck continent? Will this compromise satisfy Italy, Spain Germany, and France?

Euro bulls seem to see it as a done deal and are not waiting for white smoke – EUR/USD is trading above 1.1460, at the highest since March. It is now vulnerable to the downside if the meeting breaks up without an accord, but leaders would not have extended talks if there was not a hope for a deal.

Broader markets are mixed, with S&P futures pointing only marginally lower and failing to provide support to the safe-haven dollar. Coronavirus cases continue surging in the US, topping 3.7 million, while the death toll surpassed 140,000. Los Angeles may impose a strict lockdown while Florida COVID-19 infections are “out of control.”

President Donald Trump downplayed the developments once again, claiming without evidence that the US has the world’s best mortality rate. His mishandling of the crisis is highly correlated to a fall in support, according to the latest opinion polls. Trump is trailing Biden by around 9%, a consistent level.

On the other hand, hopes for a coronavirus vaccine remain high. Richard Horton, Editor of The Lancet, tweeted this on Sunday:

Tomorrow. Vaccines. Just saying.

“” richard horton (@richardhorton1) July 19, 2020

His prestigious medical publication previously published updates on AstraZeneca’s efforts to develop a COVID-19 vaccine. The tweet, alongside other global, pushes to develop immunization, keep markets optimistic.

US fiscal support is gaining more attention as several of the emergency measures – such as federal unemployment benefits – are set to expire at the end of July. Trump will reportedly meet Republicans to discuss the next steps on Monday.

The economic calendar features few events on Monday, leaving the scene to European leaders and to coronavirus developments.

EUR/USD Technical Analysis

While the currency pair is at the highest levels in three months, the Relative Strength Index on the four-hour chart is still below 70 – outside overbought conditions. That implies further gains may be in store. EUR/USD is above the 50, 100, and 200 Simple Moving Averages, and momentum remains to the upside.

All in all, bulls are in control.

The next prize is 1.1495, which was March’s peak. Further above, the next levels to watch are 1.1515, 1.1570, and 1.1620, dating back to early 2019 and late 2018.

Euro/dollar is trading above the previous high of 1.1452, which now turns to support. The next cushion is the daily low of 1.1410, followed by 1.1370, a stepping stone on the way up which converges with the 50 SMA. Further down, 1.1325 and 1.13 await it.

More Central banks make way for governments to act and move markets, but there is only one real boss