- EUR/USD bulls on track for additional highs on a weekly close above 1.2166.

- Market’s attention will turn to the last Fed interest rate decision of 2020, top of the hour.

EUR/USD is currently trading at 1.2168 and up by 0.15% having travelled from a low of 1.2145 to a high of 1.2212.

The euro is bid ahead of the Federal Open Market Committee’s outcome of their two-day meeting and the Federal Reserve’s subsequent interest rate decision.

The single currency caught a bid on the back of surprisingly strong European numbers with the manufacturing PMIs printing at 55.5 vs forecast 53, services at 47.3 vs 41.9 forecasts, and the composite at 49.8 vs forecast 44.

In contrast, the US PMIs were balanced but services were slightly worse than expected, giving the euro the edge.

Meanwhile, investors figure that in the US, services face greater pressure from a resurgence in COVID cases.

While US states have mostly not resorted to lockdowns like the ones implemented in parts of Europe, rising cases still weigh negatively on service activity.

Manufacturing, on the other hand, printed higher than expected, suggesting that this sector of the economy is better equipped to handle rising virus cases.

In other data, US Retail Sales fell 1.1% month-on-month in December versus the -0.3% consensus forecast with weakness seen throughout the report.

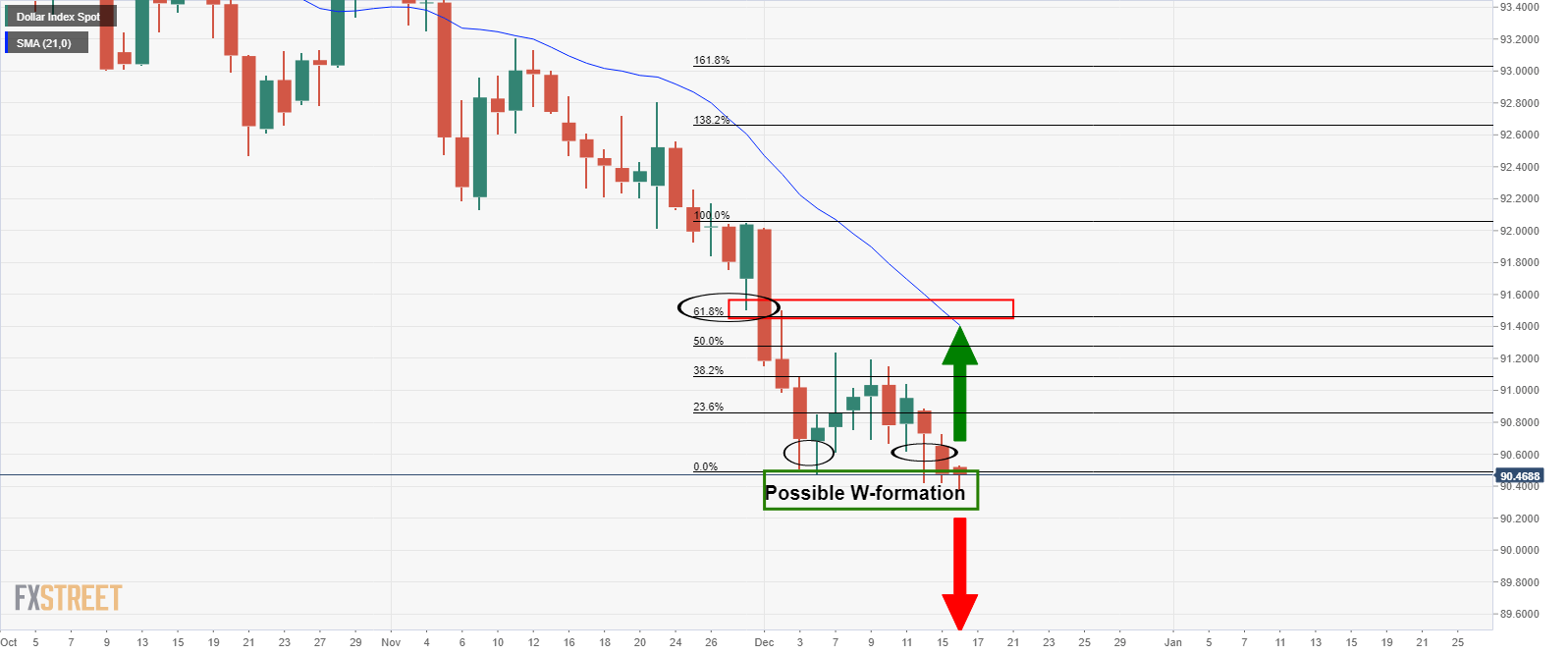

DXY daily chart

Nevertheless, a risk-on tone in the US continues to weigh on the DXY which printed a fresh 2.5 year low.

A close below 0.9042 will likely invalidate the bullish W formation and bottoming pattern and lead to lower lows, supporting the euro higher:

Brexit dal hopes have traction

Positive soundings from the European Union on Brexit talks helped lift investor sentiment.

The EU’s chief executive explained on Wednesday that she could not say if there would be a trade deal with Britain but there had been progressing and the next few days would be critical.

Ursula von der Leyen said discussions on access to British fishing waters for EU vessels were “still very difficult”.

However, she also said that negotiators had moved forward on the other most contentious element – guarantees of fair competition for companies.

It is Fed day, what to expect?

Meanwhile, all eyes now turn to the Fed.

”We think the Federal Reserve will stick to its game plan without any major changes,” analysts at Danske Bank argued.

Key points:

”We may see the Fed changing its QE forward-guidance to outcome-based forward guidance but we think the Fed will continue buying at the current pace for some time.”

”The fact that breakeven inflation expectations continue to move higher, which is the main reason why the US yield curve has steepened, means that there is little pressure for the Fed to do much.’

However, the analysts at Danske, however, argue that the risk is that ”it will do a twist by buying US Treasuries with longer maturities, which is likely to lead to even lower US real rates.”

EUR/USD technical analysis

Meanwhile, the bulls are in charge still while above prior support following a 38.2% Fibonacci retracement of the weekly/daily impulse into 1.2175.

However, on a break below the support, the weekly target and confluence of the daily 61.8% and the weekly 38.2% Fibos would be highly compelling.

A meaningful retracement to the 38.2% Fibo level comes in at 1.2013 and can be expected considering how stretched the weekly impulse has been without any significant correction.

However, staying with the trend, the monthly -0.272% Fibo of the monthly correction has already been breached, so bulls are on track to complete a move to the -0.618% Fib target in the 1.2267 level; A weekly close above 1.2166 keeps the bulls on track for this target.

-637437383398897995.png)