- EUR/USD is consolidated in the weekly highs ahead of the Fed.

- Risk-on sentiment is keeping the bulls on track for a monthly Fibo target.

EUR/USD is trading at 1.2153 in a tight range between 1.2145 and 1.2155, flat on the Asian session so far.

The day in Asia, ahead of the Federal Reserve meeting in New York trade later today, started with momentum from gains on Tuesday in US and European stocks, gold, oil and U.S. Treasury yields.

Bulls have rejoiced this week on the optimism surrounding fiscal stimulus and for a trade deal on the Brexit front.

The risk-on the environment has sunk the US dollar to fresh 2.5 year lows.

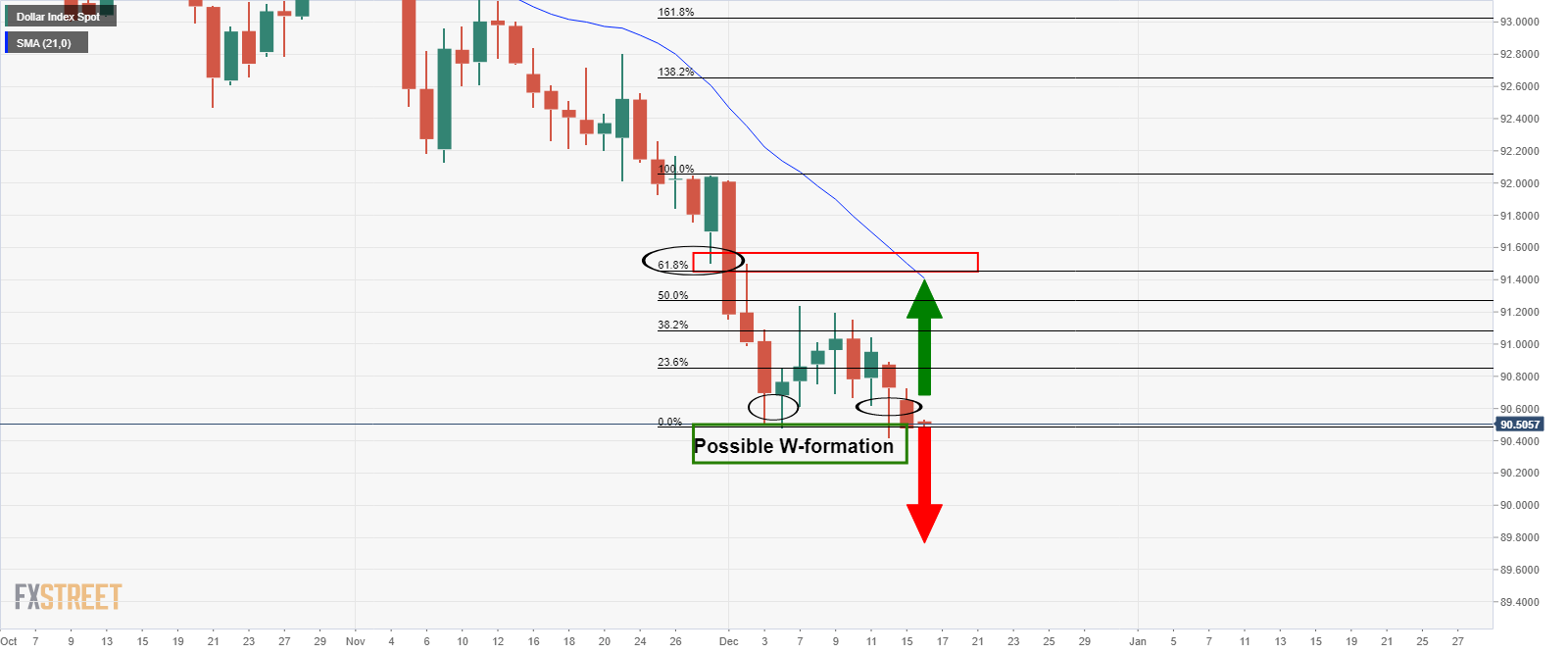

DXY daily chart

Markets will now look to the Fed for new projections.

Investors will want to hear their take on whether a double-dip recession is to be averted due to the roll-out of the vaccine’s which could lead to a faster road to economic recovery.

The central bank will release a statement with a press conference set for the afternoon from Fed Chair Jerome Powell.

The Fed could also give guidance on when and how it might change its bond purchases, impacting views on longer-term yields and exchange rates.

EUR/USD technical analysis

The bulls are in charge still while above prior support following a 38.2% Fibonacci retracement of the weekly/daily impulse into 1.2175.

However, on a break below the support, the weekly target and confluence of the daily 61.8% and the weekly 38.2% Fibos would be compelling.

Considering how stretched the weekly’s upside is, a significant correction to the 38.2% Fib retracement comes in at 1.2013.

That being said, the monthly -0.272% Fibo of the monthly correction has already been breached, which opens the route towards a -0.618% Fib target in the 1.2267 level. A weekly close above 1.2166 keeps the bulls on track for the said target.

-637436798535063977.png)