- EUR/USD has been licking its wounds and edging higher as markets remain cautious.

- Optimism about US stimulus, upbeat data or an accelerated vaccine campaign may push the pair higher.

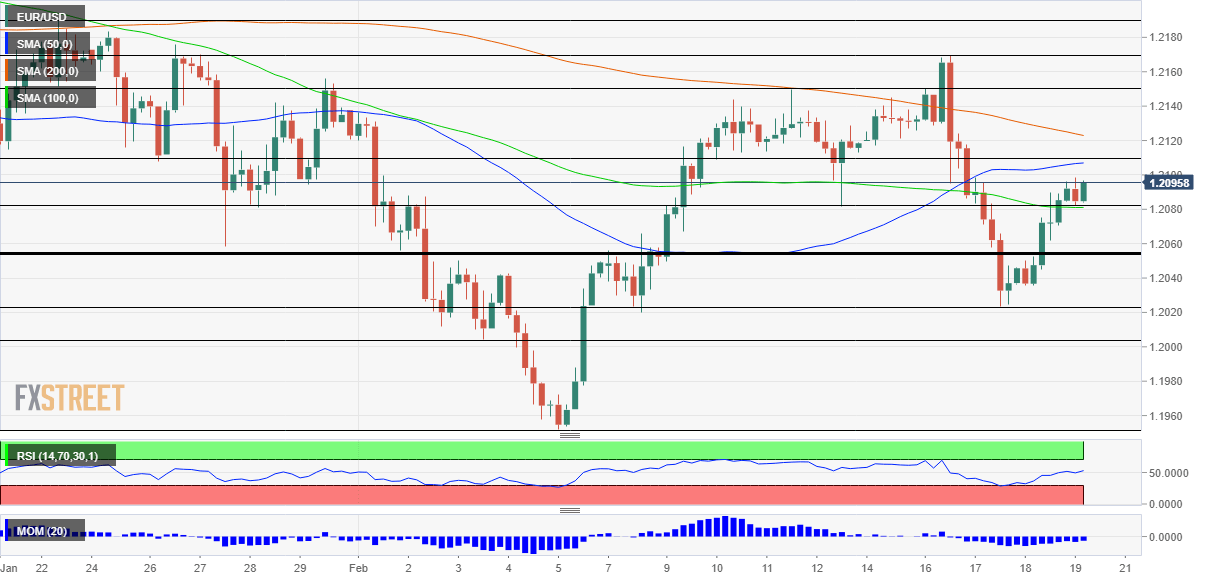

- Friday’s four-hour chart is painting a mixed picture.

A classic dead-cat bounce or a meaningful correction that foreshadows a rally? The recent 70-pip upward move in EUR/USD has left many traders perplexed amid growing uncertainty on several fronts. Will skies clear on Friday? Here are the critical questions – that may receive some answers as the week draws to a close.

Is the economy improving? US jobless claims have been a bitter disappointment, leaping to 861,000 and ending a winning streak of declines. The stark reminder about the state of America’s labor market contrasted robust retail sales figures for January released beforehand.

Friday’s spotlight is on Markit’s preliminary Purchasing Managers’ Indexes for February. In the old continent, these forward-looking surveys are set to show an ongoing divide between the struggling services sectors – hit by lockdowns – and the humming manufacturing ones. Are managers seeing through the current suffering and into a vaccine-led recovery? That could boost the euro.

On the other side of the pond, Markit’s US PMIs are projected to show robust activity, and that may improve the mood. America also releases existing home sales figures for January, which may add to optimism. Despite the hardship of the pandemic, the housing sector is buoyant.

If US data is rosy, it could cause Treasury yields to rise and boost the dollar. However, if the statistics are only cautiously optimistic, it would lift sentiment while allowing the safe-haven dollar to decline.

The second question for market is: Will President Joe Biden make progress on his covid relief package? Negotiations within his Democratic Party continue and one of the sticking points is if an increase in the minimum wage can be included in the package. Congress is gearing up to vote on as much as $1.9 trillion in aid late next week. Any delay may weigh on markets while positive developments may boost them.

Moreover, there are initial reports that the White House is already mulling a second fiscal stimulus focused on infrastructure and worth some $3 trillion. Details on such spending would also be positive.

The third question related to vaccines: European countries are finally receiving more doses of various jabs, but reports suggest that some are hesitating to take the AstraZeneca shots. Britain and the EU had an ugly row over supplies of this immunization solution and that has eroded confidence. Nevertheless, Astra’s vaccines are widely deployed in the UK and if the continent accepts these doses at a faster pace, the euro may rise.

In the US, the “deep freeze” storm in the southern US has slowed the distribution of COVID-19 vaccines, and bad weather is moving up north. If delays persist, it could weigh on sentiment. However, adverse weather affects only distribution and not production – and is unlikely to last.

All in all, there are reasons for optimism about the global economy and EUR/USD’s prospects to advance, but there is room for caution as well.

EUR/USD Technical Analysis

Euro/dollar has topped the 100 Simple Moving Average on the four-hour chart but remains capped under the 100 and 200 SMAs. While downside momentum has eased, it has yet to turn positive. All in all, the picture is mixed.

Resistance awaits at 1.2110, which provided support last week and is also where the 50 SMA hits the price. It is followed by 1.2150, a swing high and then by 1.2170, the February top.

Some support awaits at 1.2080, the daily low, followed by 1.2055, which is a critical cushion and a separator of ranges. Further down, 1.2020 and 1.20 await EUR/USD.

Where next for stocks, gold and Bitcoin in a world where bad news becomes good news