- EUR/USD has eventually gained ground after the Fed’s dovish shift.

- A full buildup to the US Non-Farm Payrolls, EZ inflation, and coronavirus news are all eyed.

- Early September’s chart is painting a mixed picture.

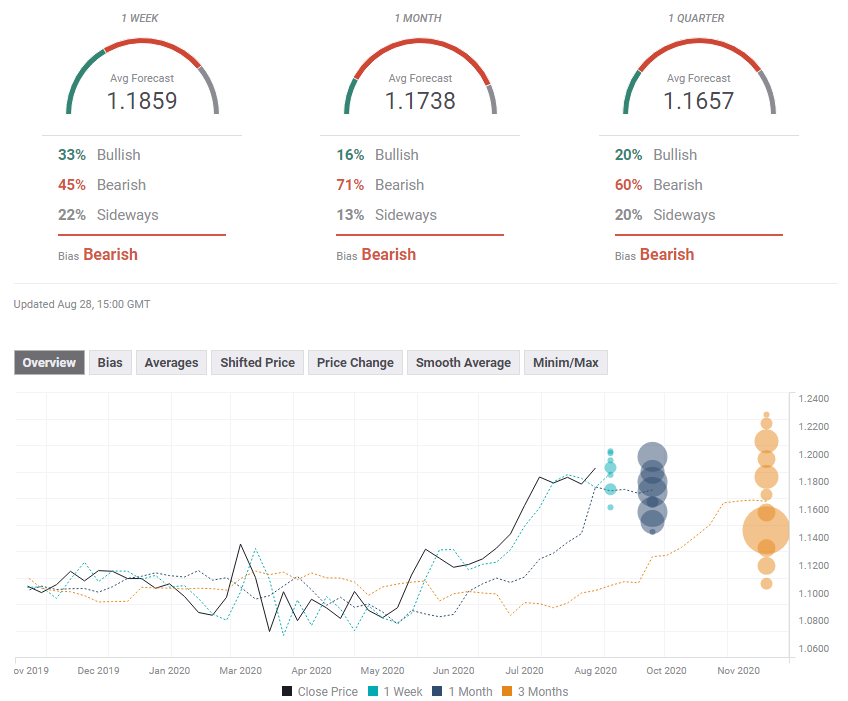

- The FX Poll is pointing to an ongoing decline for the currency pair.

EUR/USD has been marching higher in response to the Fed’s dovish shift. Is it set to fall? September kicks off with a full buildup to the all-important Non-Farm Payrolls, with European developments such as inflation – and coronavirus figures – also of high interest.

This week in EUR/USD: Fed whipsaw ends with a stronger euro

Lower rates for even longer – the Federal Reserve will allow for inflation to overshoot and “catch up” before considering hiking borrowing costs. Jerome Powell, Chairman of the Federal Reserve, also said employment has a priority over inflation. Powell announced the shift in its policy for the next five years – a long-term change.

The dollar initially dived, but a mix of “buy the rumor, sell the fact” and doubts that prices will pick up, in any case, triggered a rebound. In the short and medium terms, zero rates were already on the cards.

Later on, the dovish narrative took hold and the greenback suffered a significant drop across the board, allowing EUR/USD to top 1.19.

See

- Powell Quick Analysis: Fed fires on all cylinders, three factors fueling gold stocks, downing dollar

- Fed Rundown: Lower for (even) longer, and what’s next for the dollar after the whipsaw

US economic figures were mixed and offset each other. Second-quarter Gross Domestic Product was upgraded to a fall of 31.7% annualized, better than estimated but still devastating. Figures for July were more encouraging with a leap in New Home Sales to above 900,000 annualized – the highest since 2006.

On the other hand, continuing claims disappointed by remaining stubbornly high at around 14.5 million in the week ending August 14 – when Non-Farm Payrolls are conducted. Another recent figure also fell short of estimates – the Conference Board’s consumer confidence dropped to 84.8, the lowest in six years.

Coronavirus news was mostly upbeat. While cases continue rising in the old continent, they are edging lower in America, allowing for a better market mood. Perhaps more importantly, hopes for a vaccine and a cure remain high, with optimistic announcement coming from Moderna and other pharmaceutical companies.

On the other hand, COVID-19 mortalities remain elevated in the US:

Source: FT

While policymakers are concerned about the increase of coronavirus cases in Europe, the German Business Climate advanced to 92.6 points in August, extending its recovery. Moreover, Olaf Scholz, Germany’s finance minister, said the recovery from the lockdowns was better than expected.

Overall, the last full week of August witnessed a weaker dollar amid the Fed’s “paradigm shift. September could be different.

Eurozone events: Coronavirus stats, inflation figures, and more

The increase in eurozone COVID-19 cases has not materialized into pressure on health systems, nor deaths. However, there is a lag between infections and mortalities. Some countries are cautiously going back to school in early September and any deterioration – especially an outbreak in a school – could trigger setbacks and weigh on the euro.

Source: FT

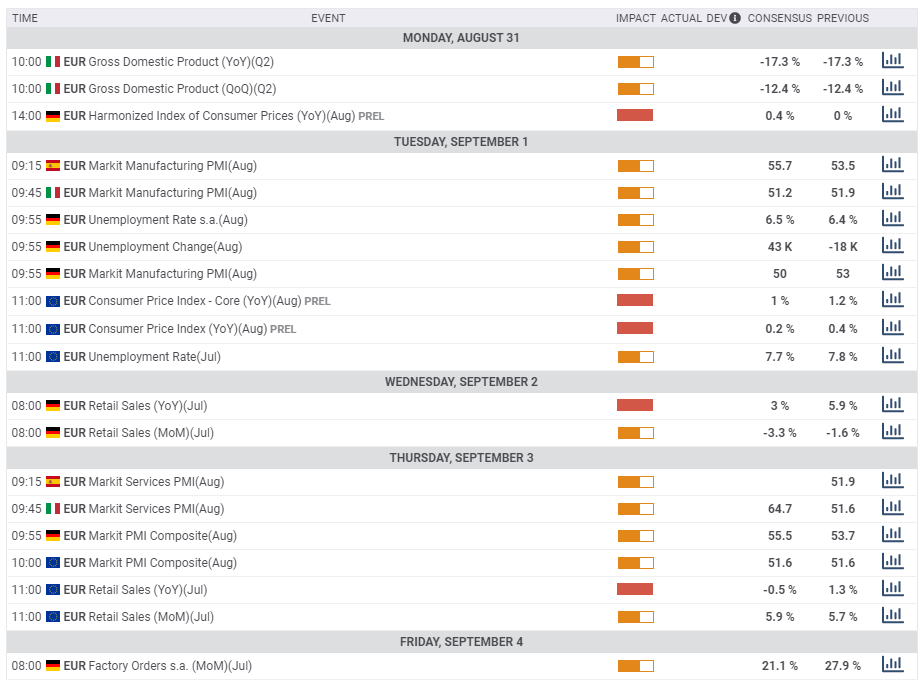

The economic calendar consists of updates to GDP figures for the devastating second quarter and more importantly, Markit’s purchasing managers’ indexes. The statistics for hard-hit Spain could stand out, especially if they turn south as France’s figures did.

After the Fed changed its inflation focus, preliminary Consumer Price Index data from the eurozone for August is of interest. Both headline inflation and Core CPI are set to decline but remain within well-known ranges. A drop of underlying inflation to below 1% would be a cause for concern for the European Central Bank.

German retail sales and factory orders are both forecast to advance but at different paces. Consumers are somewhat hesitant to patron restaurants and shop outdoors. Investors will want to see how fast or slow the recovery goes.

Here are the events lined up in the eurozone on the forex calendar:

US events: NFP buildup, pickup in political interest

Will the number of US COVID-19 deaths begin falling? The improvement in case numbers is not reflected in mortalities but could come in early September. Without that, worries about ongoing sluggishness may dog the dollar.

Opinion polls will likely gain more traction as America marks two months ahead of the elections. More importantly, the party conferences – that create noise in the polls – are over and post-events polls will provide an updated state of the race.

President Donald Trump continues trailing challenger Joe Biden but the gap is narrowing, especially in battleground states. Will the Republicans receive a convention bump? Uncertainty is high especially around control of the Senate.

Here is the state of the presidential race:

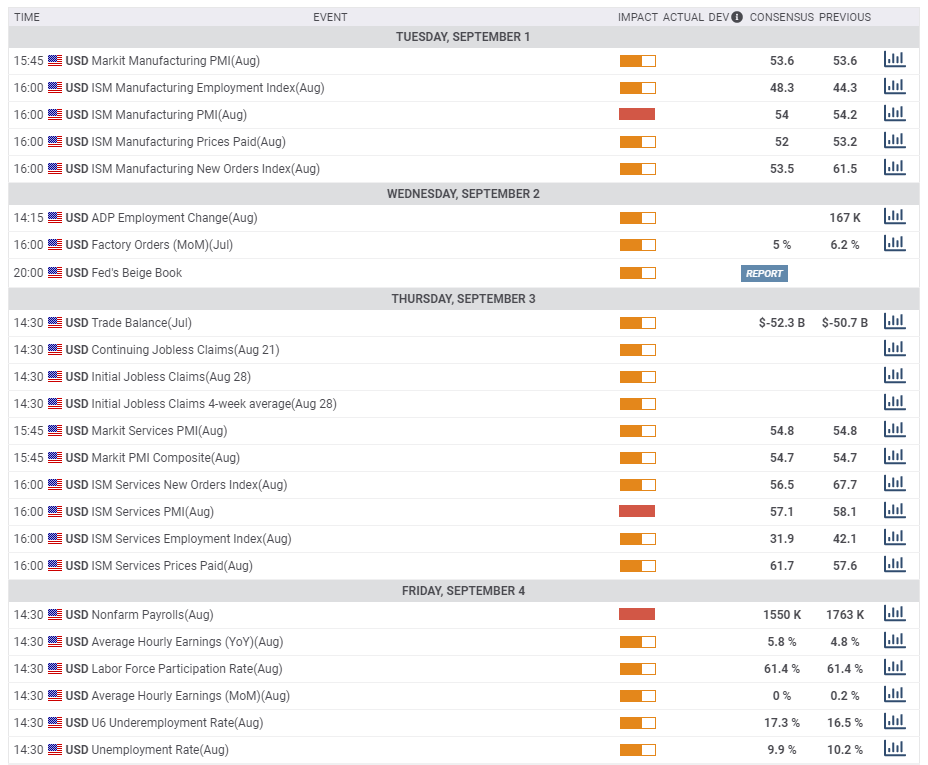

The economic calendar is packed, culminating in Friday’s all-important Non-Farm Payrolls report for August. Investors want to see if the lapse of special fiscal stimulus at the end of July – and the ongoing coronavirus crisis – caused the recovery to slow down.

The ISM Manufacturing PMI is set to remain stable at around 54, indicating growth, while the employment component carries expectations of staying stuck under 50 – signaling contraction.

ADP’s private-sector jobs report is due out on Wednesday, yet it has been losing clout in the COVID-19 era, missing the mark several times and barely indicating the trend. It showed an increase of 167,000 positions in July while official statistics pointed to an increase of over one million private-sector jobs.

Thursday’s ISM Non-Manufacturing PMI will likely continue pointing to growth in the economy – but sluggish hiring in the sector where most Americans are employed.

Other figures such as factory orders and weekly jobless claims – for periods beyond the NFP survey weeks – may have an impact if they all go in the same direction, but will probably play second fiddle to the jobs report clues.

Finally, Friday’s Non-Farm Payrolls figures carry expectations of another hefty gain – or restoration – of around 1.5 million jobs, below July’s near 1.8 million increase and June’s near 4.8 million rise. That would an ongoing, yet slower recovery.

Economists expect the unemployment rate to edge just below 10% while the underemployment rate is forecast to move above 17%. It is essential to note that the jobless level is dependent on the participation rate, which is depressed below 62%.

A disappointing jobs report could hit stocks and potentially prompt lawmakers to inject more fiscal support. The $600/week federal unemployment insurance top-up lapsed at the end of July and is weighing on the world’s largest economy. However, the day of reckoning may wait for later in September.

Here are the scheduled events in the US:

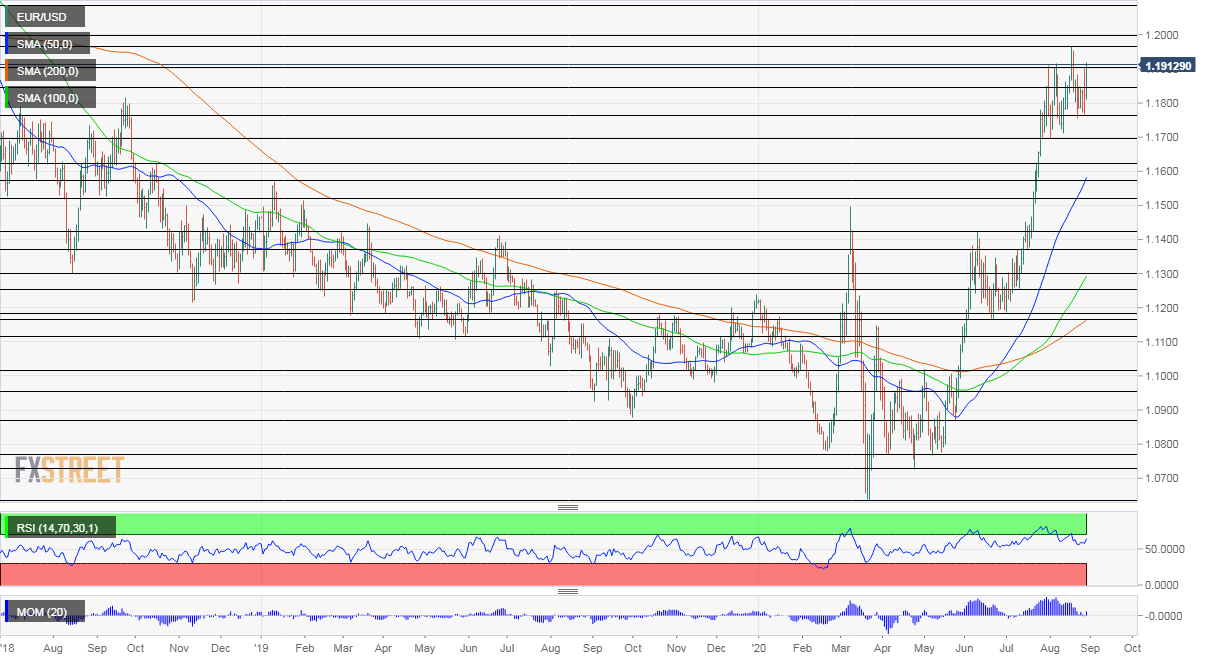

EUR/USD Technical Analysis

The Relative Strength Index on the daily chart is still below 70 – outside overbought conditions – and allowing for more rises. On the other hand, upside momentum has weakened, indicating hesitation. Euro/dollar is trading well above the 50, 100, and 200-day Simple Moving Averages, supporting further gains.

All in all, bulls are in the lead but do not have full control.

The currency pair is battling 1.1915, an initial peak in August. Looking up, resistance awaits at the 2020 high of 1.1965 recorded in mid-August. It is followed by the all-important 1.20 level. Further above, the next upside target is 1.2090, a level dating back to 2018.

Support is at 1.1850, a separator of ranges in late August. It is followed by 1.1750, a support line from earlier in the month, and by 1.17 – a stubborn double bottom.

EUR/USD Sentiment

The Fed’s dovish stance may provide more tailwind for gradual rises. The moves could accelerate if Non-Farm Payrolls fall short of estimates and weaken the dollar. On the other hand, if European countries impose restrictions to depress the resurgence of the virus, the euro could struggle.

The FXStreet Poll is showing that experts have only upgraded their forecasts for the short term but left medium and long term goals unchanged. It seems they have doubts, with all objectives falling below the current price.