- The mood around spot remains depressed around the 1.1200 handle.

- The greenback keeps the positive mood near 97.70.

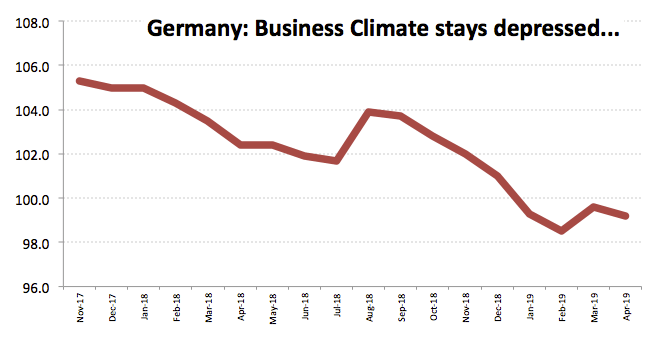

- German IFO disappointed expectations for the current month.

Poor results from the German docket motivated EUR/USD to briefly drop below the critical support at 1.1200 the figure, where it is now looking to consolidate.

EUR/USD remains offered near YTD lows

Spot came under further downside pressure and staged an ephemeral break below the 1.1200 handle after the German IFO came in below estimates in all of its components for the current month.

In fact, Business Climate dropped to 99.2 (from 99.6), Current Assessment slipped back to 103.2 (from 103.8) and Business Expectations decreased a tad to 95.2 (from 95.6), once again confirming the view of the slowdown in the domestic economy and in the broader euro region.

Earlier in the week, ECB’s B.Coeure admitted the deceleration of the German economy had been stronger than initially forecasted, although he advocated for a rebound in the second half of the year if there is a US-China trade agreement.

What to look for around EUR

The broad-based risk-appetite trends and USD-dynamics are posed to rule the sentiment surrounding the European currency for the time being, all in combination with the onoging US-China trade dispute and potential US tariffs on EU products. Recent weak results from key fundamentals in the region plus a now unlikely rebound in the activity in the second half of the year have added to the ongoing concerns that the slowdown in the region could last longer that expected and the ECB is therefore likely to remain ‘neutral/dovish’ for the foreseeable future (say until mid-2020?). On the political front, headwinds are expected to emerge in light of the upcoming EU parliamentary elections in late May, as the populist option in the form of the far-right and the far-left movements appears to keep swelling among voting countries.

EUR/USD levels to watch

At the moment, the pair is losing 0.13% at 1.1212 and faces initial contention at 1.1192 (low Apr.23) seconded by 1.1183 (low Apr.2) and finally 1.1176 (low Mar.7). On the upside, a breakout of 1.1245 (21-day SMA) would target 1.1290 (55-day SMA) en route to1.1323 (high Apr.17).