- EUR/USD loses the grip and approaches 1.10.

- German Consumer Climate improves in February.

- The FOMC meeting will be the salient event later on Wednesday.

The bearish sentiment around the single currency stays well and sound so far this week and is now forcing EUR/USD to test the psychological mark at 1.1000 the figure following the opening bell in Euroland.

EUR/USD ignores German data, focused on the Fed

The pair has resumed the downside on Wednesday following the tepid recovery on Tuesday’s session. The focus of attention has once again shifted to a potential (and sustainable) break below the 1.10 level.

As usual, the improved sentiment in the greenback continues to exert further downside pressure on the spot. In fact, auspicious results in the US docket as of late have somewhat mitigated speculations that the apparent loss of momentum in the economy could have gathered pace, all morphing into further legs to the buck, which trades in the area of 2020 highs above 98.00 the figure when gauged by the US Dollar Index (DXY).

In the meantime, risk trends continue to alternate direction on the back of headlines from the Wuhan virus and its potential effects on the global growth. The recent drop in US and German yields have dragged the differential spread to sub-200 pts for the first time since October 2017 without triggering any (upside) reaction EUR.

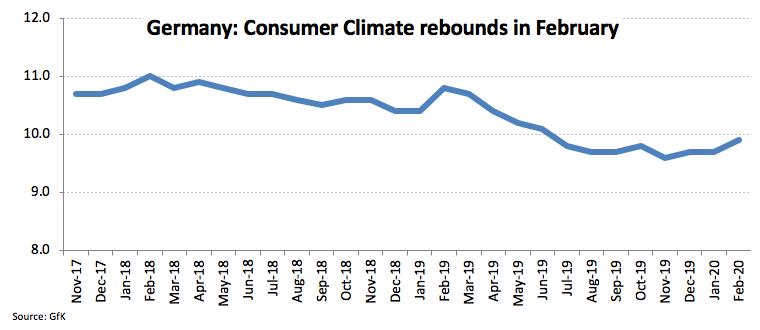

Earlier in the session, German Consumer Climate tracked by GfK improved to 9.9 for the month of February, although the euro has practically ignored the results. Later on Wednesday, the Federal Reserve is expected to leave the Fed Funds Target Range unchanged at 1.50%-1.75%, leaving the bulk of the attention to Chief Powell’s views at his press conference.

What to look for around EUR

The pair remains well under pressure and continues to put the 1.1000 support to the test. Dynamics around the buck are expected to remain the exclusive driver of the pair’s price action for the time being along with alternating risk appetite trends in response to developments from the Wuhan coronavirus. On another scenario, the ECB is expected to finish its strategic review (announced last Thursday) by year-end, leaving speculations of any change of the monetary policy before that time pretty flat. Further out, some better-than-expected results in the euro region as of late seem to have lent support to the idea that the bloc could have left the worst behind, although that view looks premature, to say the least.

EUR/USD levels to watch

At the moment, the pair is retreating 0.19% at 1.1001 and a breakdown of 1.0998 (weekly/2020 low Jan.28) would target 1.0989 (low Nov/14 2019) en route to 1.0981 (monthly low Nov.29 2019). On the flip side, the next hurdle aligns at 1.1067 (100-day SMA) seconded by 1.1088 (55-day SMA) and finally 1.1127 (200-day SMA).