- EUR/USD adds to Thursday’s gains around the 1.1850 level.

- The greenback stays offered as markets digest the FOMC gathering.

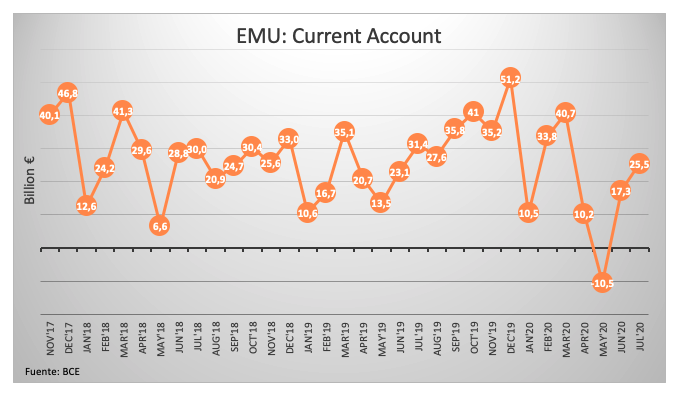

- EMU’s Current Account surplus widened to €25.5 billion in July.

The upbeat momentum around the single currency remains in place in the second half of the week, with EUR/USD flirting with daily highs near 1.1870.

EUR/USD bounces off 1.1730

EUR/USD is advancing for the second session in a row on Friday, prolonging the recovery after bottoming out in fresh monthly lows in the 1.1740/35 band recorded on Thursday.

In fact, the pair regained buying interest after market participants digested the Fed’s message at its event on Wednesday. In addition, signs that the economic rebound could be losing some traction in tandem with mixed-to-negative results from US fundamentals have been also collaborating with the renewed selling bias surrounding the buck.

In the data space, the Current Account surplus in the euro area ticked higher to €25.5 billion during July, while Italian New Orders and Industrial Sales extended the recovery and expanded at a monthly 3.7% and 8.1%, respectively, in the same period. Later in the session, ECB’s Luis De Guindos and Isabel Schnabel are due to speak.

Across the pond, the focus of attention will be on the flash gauge of the Consumer Sentiment for the current month.

What to look for around EUR

EUR/USD dropped and recorded fresh monthly lows near 1.1740 following the FOMC gathering. Despite the move, the pair’s outlook remains positive and bouts of weakness are so far deemed as short-lived and look contained. In addition, the improved sentiment in the risk-associated universe, auspicious results from domestic fundamentals – which have been in turn supporting further the view of a strong economic recovery following the coronavirus crisis – as well as a calmer US-China trade front are all underpinning the constructive view on the single currency. The solid positive stance in the speculative community, the latest message from the ECB and the euro area’s current account position also collaborate with this view on the currency.

EUR/USD levels to watch

At the moment, the pair is gaining 0.08% at 1.1856 and a breakout of 1.1965 (monthly high Aug.18) would target 1.2011 (2020 high Sep.1) en route to 1.2032 (23.6% Fibo of the 2017-2018 rally). On the flip side, the next support emerges at 1.1737 (monthly low Sep.17) seconded by 1.1709 (38.2% Fibo of the 2017-2018 rally) and finally 1.1695 (monthly low Aug.3).