- The pair keeps the daily gains well above the 1.1200 handle.

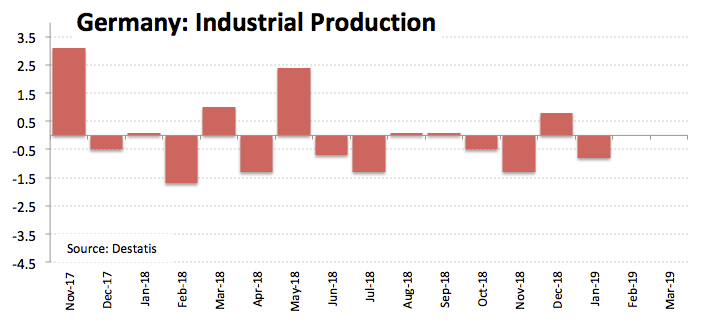

- German Industrial Production unexpectedly contracted in January.

- US Retail Sales expanded 0.2% MoM in January.

The sentiment around the shared currency remains positive so far on Monday and has taken EUR/USD to fresh 2-day tops near 1.1260, where sellers turned up.

EUR/USD unchanged on US docket

After climbing as high as the boundaries of 1.1260 during early trade, spot met some selling pressure and has now receded to the 1.1240 region, where it is now looking to stabilize.

Absent news from the US-China trade front and with markets already digesting the recent ECB meeting, USD-dynamics have come to the fore as the main driver of the pair’s price action, at least in the very near term.

In this regard, US headline Retail Sales expanded at a monthly 0.2% during the first half of the year, while Core sales gained 0.9% inter-month, both prints bettering expectations. Earlier in the day, German Industrial Production unexpectedly contracted 0.8% MoM during January.

What to look for around EUR

The sentiment around the shared currency is expected to remain under heavy pressure as market participants continue to adjust to the fresh dovish stance from the ECB and the prospects of no hikes at least until Q3-Q4 2020. On the political front, headwinds are expected to emerge in light of the upcoming EU parliamentary elections, where the focus of attention will be on the potential increase of the populist option among members.

EUR/USD levels to watch

At the moment, the pair is gaining 0.07% at 1.1239 and a breakout of 1.1258 (high Mar.11) would target 1.1312 (21-day SMA) en route to 1.3172 (55-day SMA). On the other hand, the next support aligns at 1.1176 (2019 low Mar.7) followed by 1.1118 (monthly low Jun.20 2017) and finally 1.1021 (high May 8 2017).