- EUR/USD fades the earlier spike to the vicinity of 1.1830.

- EMU flash Q2 GDP came in at -12.1% QoQ.

- US Retail Sales, Industrial Production, U-Mich next of relevance.

After reaching weekly tops near 1.1870 on Thursday, EUR/USD came under some selling pressure and is now hovering around the 1.1800 neighbourhood.

EUR/USD looks to data, USD

Following three consecutive daily advances, EUR/USD is now attempting to extend the weekly recovery, which appears so far limited by Thursday’s peaks in the 1.1865/70 band.

The macro scenario remains unaltered so far, where the investors’ attention keeps gyrating around the US political stalemate, relegating to a secondary role the progress of the pandemic and developments from the economic recovery worldwide.

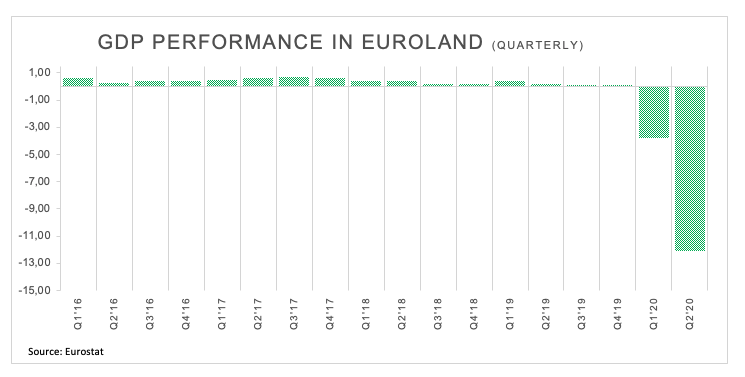

In the euro docket, another estimate of the Q2 GDP showed the economy of the bloc is expected to contract 12.1% QoQ during the April-June period and 15.0% on an annualized basis. Additional data see the Employment Change to contract 2.8% QoQ during the same period.

Across the pond, July’s Retail Sales are forecasted to have expanded around 2.0% MoM. Further US data will see Industrial/Manufacturing Production, Capacity Utilization and the flash gauge of the U-Mich index.

What to look for around EUR

EUR/USD pushed higher and recorded new highs near 1.1920 earlier in the month, subsequently sparking a corrective downside that met solid contention in the 1.17 region for the time being. The July-August rally, while largely triggered by broad-based dollar-selling and improved sentiment in the risk-associated universe, found extra sustain in auspicious results from domestic fundamentals, which have been in turn supporting further the view of a strong economic recovery following the coronavirus crisis. Also lending wings to the momentum around the euro appear the recently clinched deal on the European Recovery Fund – which helped putting political fears within the bloc to rest (for now) – and the solid position of the current account in the region.

EUR/USD levels to watch

At the moment, the pair is retreating 0.02% at 1.1810 and faces the next support at 1.1711 (weekly low Aug.12) followed by 1.1695 (monthly low Aug.3) and finally 1.1495 (monthly high Mar.9). On the other hand, a breakout of 1.1864 (weekly high Aug.13) would target 1.1916 (2020 high Aug.6) en route to 1.1996 (high May 14 2018).