- EUR/USD corrects lower and visits the 1.1190 region.

- USD-bulls return to the markets and push DXY higher.

- Focus remains on trade and results from EU elections.

The mood around the single currency has now deteriorated somewhat and is forcing EUR/USD to recede to sub-1.1200 levels on Monday.

EUR/USD focused on trade, risk trends

The pair has come under selling pressure today after a failed attempt to break above the 1.1215/20 band, where sit last week’s tops and a Fibo retracement of the 2019 drop.

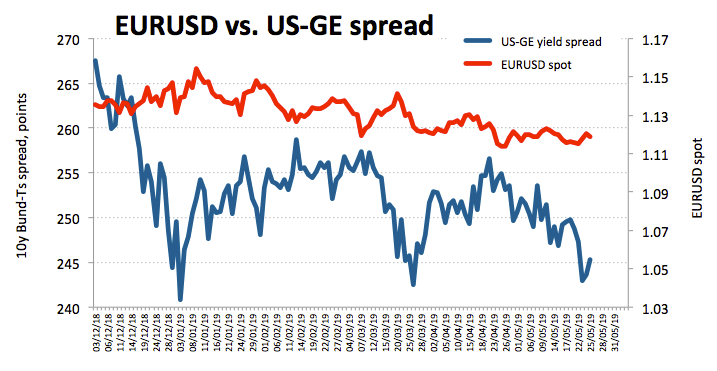

Favouring the downside in spot is the moderate pick up in the demand for the greenback, in turn fuelled by declining yields in the German money markets. In this regard, yield of the 10-year Bund is navigating fresh multi-year lows around -0.13%.

Nothing scheduled today in Euroland, whereas ECB’s Money Supply and Private Sector Loans are due tomorrow seconded by several confidence/climate gauges in the region. Later in the week, the salient event will be the publication of German advanced inflation figures for the month of May (Friday)

What to look for around EUR

Recent data releases in Euroland and Germany have poured cold water over the idea that some healing process could be underway in the region, re-shifting the focus to the ongoing slowdown and its probable duration and extension. This view has been reinforced in recent ECB minutes, where the Council appeared unconvinced about a pick up in the economic activity in the medium term horizon. That said, the current ‘neutral/dovish’ stance from the ECB is expected to persist for the remainder of the year and probable through H1 2020. The broad-based risk-appetite trends and USD-dynamics should dictate the sentiment surrounding the European currency for the time being, all in combination with the now stalled US-China negotiations and potential US tariffs on EU products. On the political front, Italian politics has re-emerged as a source of uncertainty and volatility with the main focus of attention on its fiscal struggle vs. Brussels.

EUR/USD levels to watch

At the moment, the pair is retreating 0.10% at 1.1192 and faces the next support at 1.1191 (21-day SMA) seconded by 1.1107 (2019 low May 23) and finally 1.0905 (high Mar.27 2017). On the other hand, a breakout of 1.1215 (high May 27) would target 1.1235 (55-day SMA) en route to 1.1264 (monthly high May 1).