- EUR/USD has been surging above 1.19, the highest since June 2018.

- Europe leads the US on the recovery, coronavirus, and fiscal stimulus.

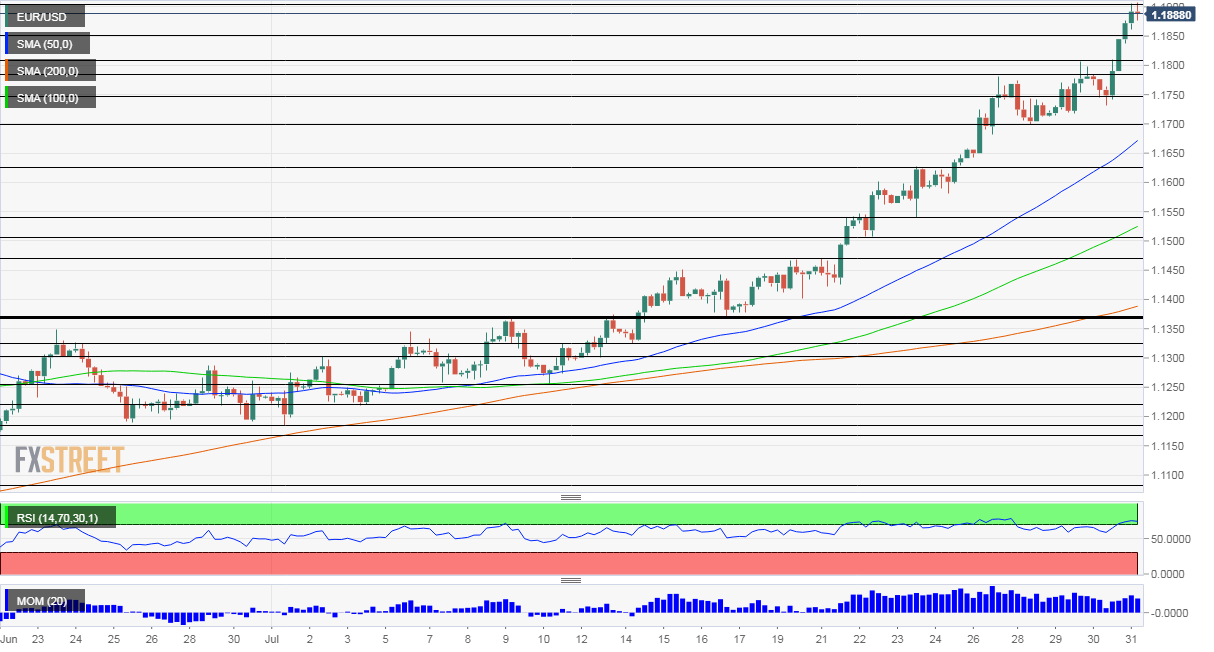

- Friday’s four-hour chart is pointing to stretched overbought conditions.

Too good to be true? EUR/USD bulls must be grateful for an impressive uptrend – and for good reasons – after periods of low volatility. However, a correction may be on the cards, especially as money managers readjust their portfolio on the last day of the week and month.

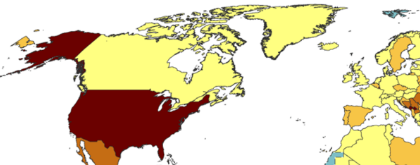

Coronavirus advantage: Despite various flareups, most notably in Spain and Belgium, Europe’s COVID-19 situation is mostly under control. The number of cases per 100,000 people is low or medium across the continent in the past 14 days, while it is over the top in the US – above 120.

Source: ECDC

American lawmakers have reported progress on talks – but there is still no white smoke on agreeing to extend federal unemployment benefits – essential for keeping consumption afloat – as well as other measures. In the old continent, EU leaders agreed on the recovery fund – a move that is the main underlying upward driver of the euro.

Moreover, the US electoral campaign – mostly out of investors’ sights so far – took a nasty twist when President Donald Trump suggested postponing the vote, triggering a backlash from Democrats and also from members of his own Republican Party. Growing fear that Trump would not acknowledge the results could further weigh on sentiment.

Second-quarter Gross Domestic Product figures are better in the US than in major European countries – yet investors are focusing on the more recent trends rather than the period that ended a month ago.

US GDP Analysis: Could have been worse, but will not improve, winners and losers in markets

The American economy squeezed by an annualized rate of 32.9%, equivalent to 9.5% quarterly, marginally better than expected. Germany’s output fell by 10.1% and France by 13.8%.

However, US initial jobless claims rose to 1.434 million in the week ending July 24, and more importantly – continuing applications jumped above 17 million in the previous week, the one when Non-Farm PAyrolls surveys are held.

The dovish message from the Federal Reserve – acknowledging the slowdown stemming from the surge in coronavirus cases since mid-June – continues grinding down the greenback as well.

Personal income figures for June and the University of Michigan’s final Consumer Sentiment Index for July are due out on Friday.

See Personal Income, Spending, and Prices June Preview: After all the agony just an average quarter?

As mentioned earlier, an end-of-month adjustment may trigger a downside correction for EUR/USD, potentially driven by a bounce in US yields. The ten-year Treasury bond yield fell to the lowest since May, and a potential bounce could allow the dollar to recover.

EUR/USD Technical Analysis

The Relative Strength Index on the four-hour chart is considerably above 70 – showing overbought conditions and implying a sharp correction. Euro/dollar appears overbought also on the daily chart.

The fresh high of 1.1909 is the immediate line of resistance, and there are no notable caps until the all-important 1.20 level which was a swing high in May 2018. Further above, 1.2090 is the next level to watch.

Looking down, 1.1850 was a peak in the summer of 2018 and is now support. It is followed by 1.1805, the initial peak earlier this week, and then by 1.1780 and 1.1750.

More Where next for the dollar, stocks and the US economy after downbeat data and the Fed