- EUR/USD gains remain capped by the 1.1800 mark.

- Poor Eurozone data and upbeat NFP helped the bears.

- German trade balance data is eyed now.

US Treasury yields are rising amid the US dollar’s buying tone, keeping the EUR/USD analysis afloat in the Asian session on Monday. In the wake of multi-month lows around 1.1740, the pair has rebounded 20 pips.

According to market reports, EUR/USD is currently trading at 1.1761, up 0.01% from yesterday.

–Are you interested to learn more about automated forex trading? Check our detailed guide-

US Treasury bond yields rebounded from lower levels, increasing the US Dollar Index (DXY), which measures the currency’s performance against six major currencies.

On Monday, the 10-year Treasury yield increased by more than 1% to 1.30%. Fed officials’ restrictive comments and a sharp surge in job vacancy data confirmed the version of an earlier than expected rate hike scenario.

Non-farm Payroll (NFP) rose to 943,000 jobs in July, exceeding market expectations of 870,000 jobs.

A disappointing series of economic data is putting a strain on the common currency. For example, the IHS Markit Construction Purchasing Managers Index (PMI) for the Eurozone stood at 49.8 in July after 50.3 in the previous month.

The governing council member of the European Central Bank (ECB), Jens Weidmann, recently suggested that monetary policy could change if inflation rates rise above the target rate.

The German trade balance is expected to be released later this week, which will allow traders to gauge the market’s sentiment.

COVID fears in the Eurozone

Although the number of infections across Europe is decreasing, Germany, France and some other European nations have reiterated giving booster shots of the vaccine to the elders, nursing home staff and people with serious ailments. However, this has been criticized by World Health Organization as Africa and Latin America is not getting insufficient amount of vaccine at the moment.

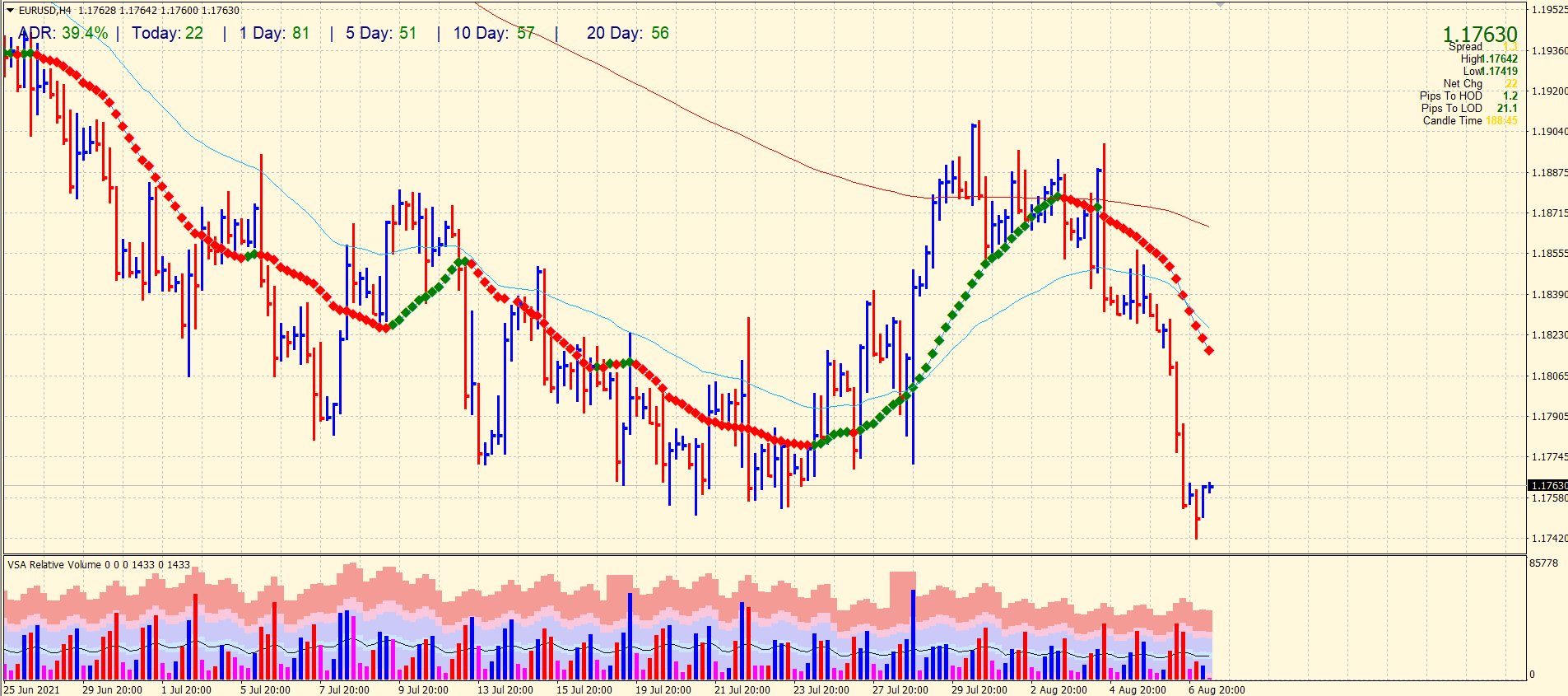

EUR/USD technical analysis: Corrective up wave to stay capped

The EUR/USD price is attempting to gain some ground after posting multi-month lows. However, the attempt will only be a corrective wave that may not be able to overcome the 1.1800 hurdle. The price is still far below the 20-period moving average on the 4-hour chart. Moreover, the 50-period and 200-period SMAs are also pointing south. The volume analysis is not healthy too. It means any upside will be a dead cat bounce and a strong selling opportunity.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.