- EUR/USD declines below 1.1750, aiming for 1.1700.

- The risk-of mood keeps the Greenback stronger across the board.

- US retail sales saw an unexpected decline today while Eurozone Q2 GDP came better than expected.

The EUR/USD forecast has turned bearish and may go for fresh YTD lows as the Greenback seeks strength across the board.

Risk-off mode continues to dominate trading activity on Tuesday, forcing the EUR / USD to make new weekly lows under 1.1750.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

Losses in the EUR/USD accelerate to 2-day lows in the mid-1.1700s as the dollar continues to recover, driven by investor attention to a safe haven.

US retail sales fell unexpectedly by 1.1% in July, while major retail sales declined by 0.4%.

Additional US data will include industrial and manufacturing production, company stocks, the NAHB index, and API weekly US crude oil inventories. A Q&A session will be conducted with Chair Powell as well.

On Tuesday, a second reading confirmed that the eurozone economy grew 2.0% quarter-on-quarter in the second quarter of 2021, as expected, and 2.0% earlier than expected.

On an annualized basis, the bloc’s GDP rose 13.6% in the second quarter, down from 13.7% in the first estimate, but above expectations of 13.7%.

However, employment in the Eurozone continued to fluctuate in line with expectations during the second quarter, with a decrease of 0.5% compared with -0.3% in the first quarter.

Considering the ECB’s repeated caution (since the last meeting), the upside potential is limited.

Asymmetric economic recovery is taking place in the region. There is steady growth in inflation. Progress and rates of vaccination against the Delta Coronavirus are satisfactory.

It is possible that political excitement will arise over the EU Recovery Fund. During the September general elections, this scenario is likely to exacerbate itself. In the aftermath of the pandemic, European equities are a likely target for investors.

–Are you interested to learn more about forex signals? Check our detailed guide-

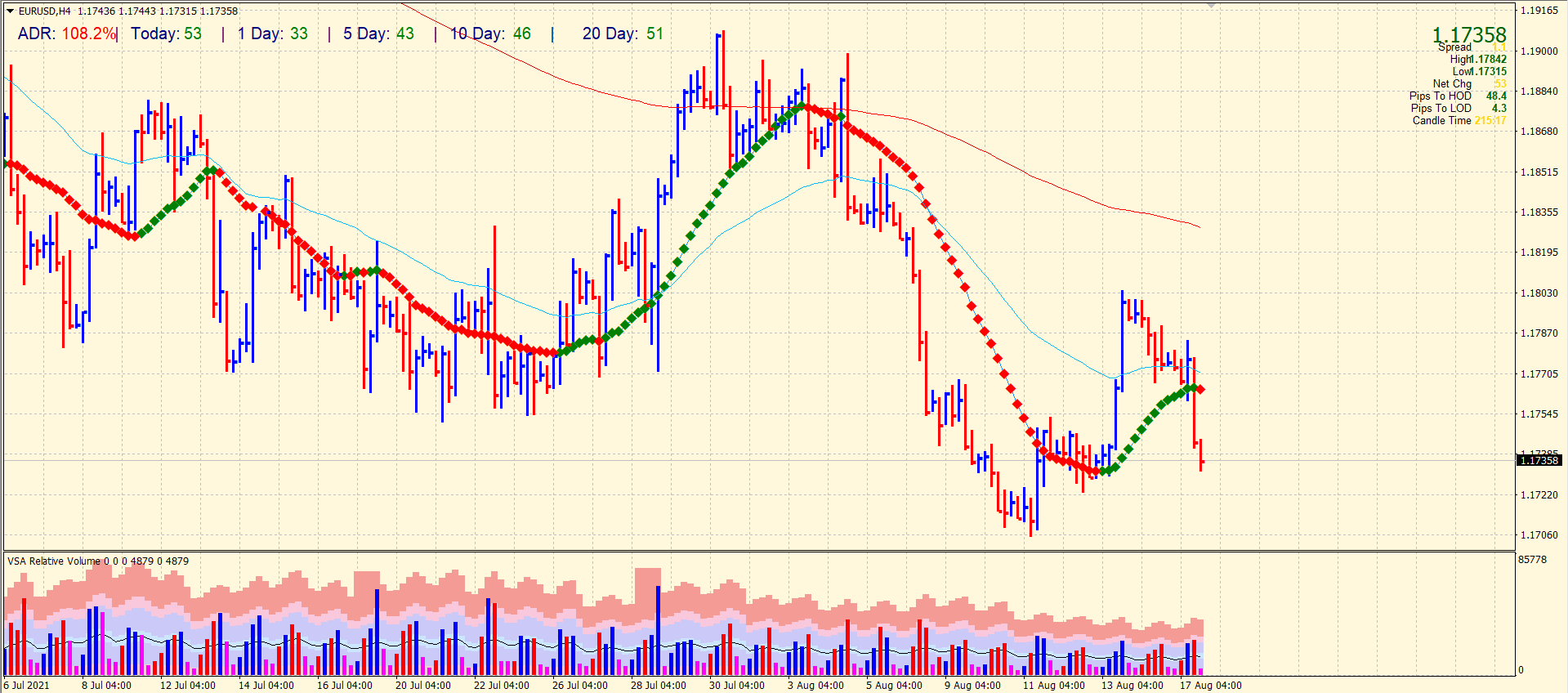

EUR/USD technical forecast: Fresh YTD lows to post

The EUR/USD pair is approaching the 1.1730 support area. However, the support may not hold, and the price is likely to target the next support of 1.1700, which provided a nearly 100-pip bounce last week. However, if the price does not hold, it is likely to post fresh YTD lows near mid-1.1650. Hence, the volume and average daily rage indicator more fall to come.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.