- The euro has felt the pressure in New York as risk appetite sours.

- The US dollar has rebounded 0.20% from the yearly lows and al eyes now turn to the Fed.

EUR/USD is currently trading at 1.1935 between a low of 1.1930 and a high of 1.2003 and done some 0.20% at the time of writing in a sell off from the psychological number in New York trade.

The spot market is jumping the gun in comparison to the overstretched positioning data that shows longs were increased by 4,000 contracts in what has already been considered as a house of cards.

US dollar firming

Meanwhile, risk markets retreated as month-end flows dominated activity which has seen the US dollar rebound significantly in the session on Monday.

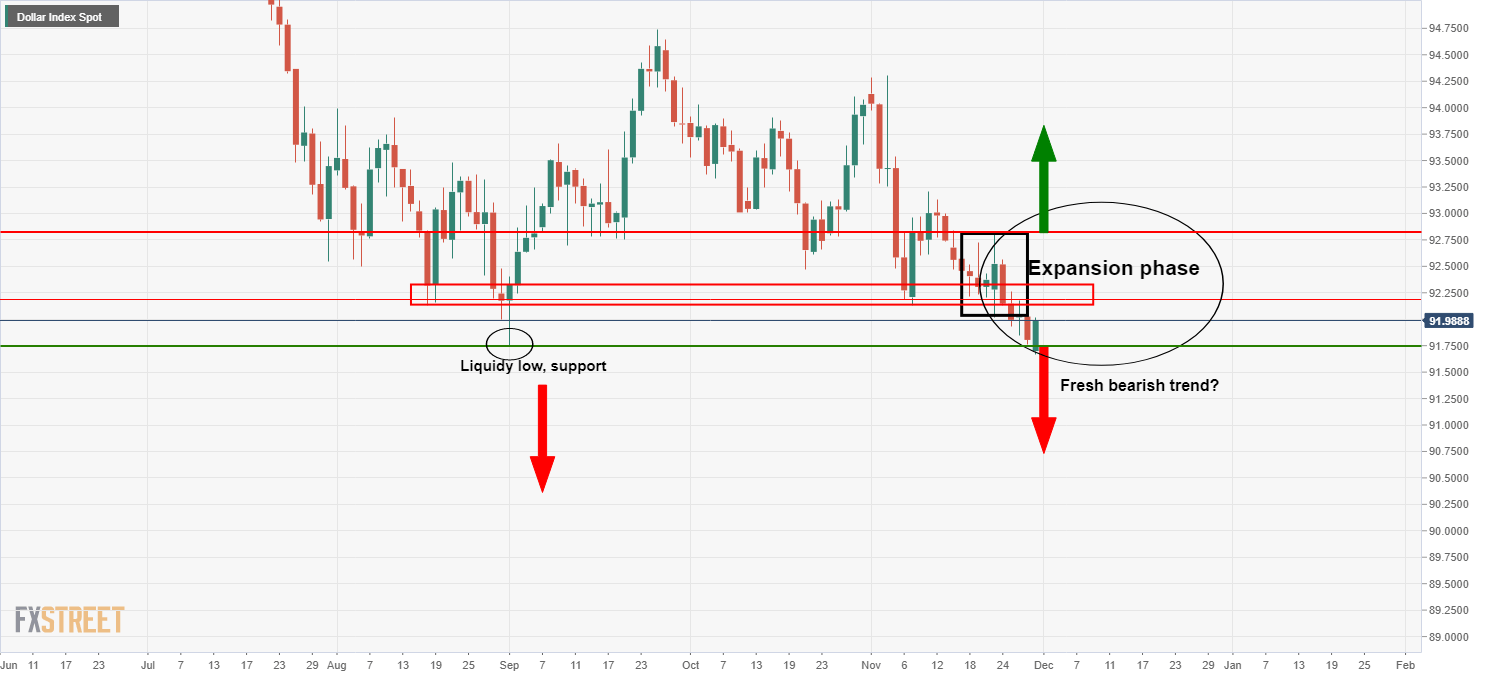

At the time of writing, DXY trades higher by 0.20% and is embarking on a break through the 92 levels having scored a high of 91.97 so far, tallying up around 50 pips on Monday from the lowest level as of April 2018.

The price is expanding from a phase of consolidation and has rallied from a critical level of support from a liquidity pool across a number of G10 currencies, mainly the euro.

DXY daily chart

There are growing signs that the US recovery is losing momentum as the fourth quarter progresses which has underpinned the dollar as risk appetite abates and stocks start to crumble from their record tops.

Meanwhile, the Federal Reserve Chairman Powell will appear before the Senate Banking Committee on Tuesday.

Traders will be paying attention to where the Fed will be about to adjust the quantity or composition of its QE purchases when it meets mid-December.

However, regardless of whether the dollar buckles under such pressure, the eurozone’s deflationary consequences of the economic crisis will likely hamstring advances in the euro.

Challenges for the ECB

”The challenges facing the ECB are enormous and a comprehensive recalibration of unconventional policy tools is warranted, the details of which will be announced next week when the ECB meets (10 December),” analysts at ANZ Bank explained.

For data, Germany’s November harmonised measure of inflation fell 1.0% MoM and was down -0.7% YoY.

”That was the fourth consecutive annual fall and equals the low set in July 2009. While the earlier German VAT cut is contributing to some of the weakness, there is no escaping the deflationary pressures sweeping through the euro area’s largest economy,” the analysts at ANZ Bank explained.

Italian November harmonised inflation was also negative, falling 0.3% YoY.

”Negative inflation in the euro area is pushing real yield up in the region and contributing to EUR/USD strength. There is little that policymakers can do to counteract euro strength in the short term,” the analysts argued.