- EUR/USD remains under pressure below the 1.17 mark.

- German Business Climate improved below expectations.

- Fed’s Jerome Powell, Initial Claims next of note in the docket.

The selling pressure around the single currency stays unabated and drags EUR/USD lower to fresh 2-month lows in the 1.1645/40 band on Thursday.

EUR/USD offered on risk aversion, looks to data and Powell

EUR/USD is extending the leg lower for the fifth consecutive session on Thursday amidst the persistent preference of investors for the safe haven universe, therefore bolstering further the demand for the dollar.

Indeed, concerns among investors prevail over the pace of the economic recovery amidst the second wave of the coronavirus pandemic, while market chatter regarding another stimulus package from the Fed appears to by dying off.

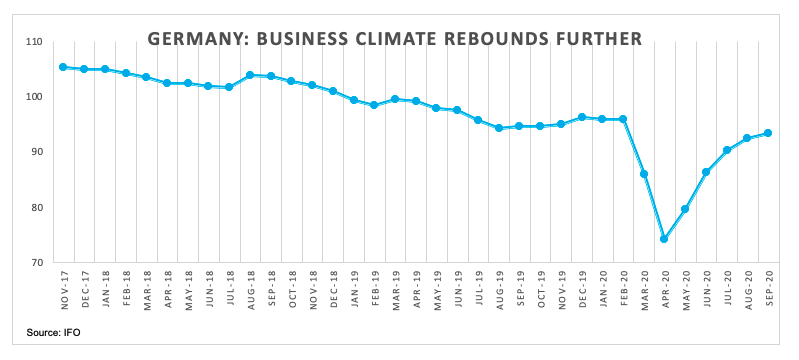

In the euro docket, the German Business Climate tracked by the IFO survey came in below estimates at 93.4 for the month of September, although it improved from the August’s reading.

Later in the session, markets’ focus is expected to remain on the last testimony by Fed’s Jerome Powell ahead of weekly Initial Claims and New Home Sales for the month of August.

What to look for around EUR

EUR/USD recorded fresh 2-month lows near 1.1640 on Thursday. Despite the move, the pair’s outlook still remains constructive and bearish moves are deemed as corrective only. Further out, the positive bias in the euro remains underpinned by auspicious results from domestic fundamentals (which have been in turn supporting further the view of a strong economic recovery after the slump in the activity during the spring), the so far calm US-China trade front and the steady – albeit vigilant- stance from the ECB. The solid position of the EMU’s current account coupled with the favourable positioning of the speculative community also lends support to the shared currency.

EUR/USD levels to watch

At the moment, the pair is retreating 0.06% at 1.1652 and faces immediate support at 1.1644 (monthly low Sep.24) seconded by 1.1495 (monthly high Mar.9) and finally 1.1447 (50% Fibo of the 2017-2018 rally). On the other hand, a break above 1.1709 (38.2% Fibo retracement of the 2017-2018 rally) would target 1.1742 (55-day SMA) en route to 1.1917 (high Sep.10).