- EUR/USD loses further ground and tests 1.0980.

- EMU Economic Sentiment deteriorated in March.

- US Retail Sales contracted 0.5% MoM in February.

The greenback keeps pushing higher on Tuesday and is now dragging EUR/USD to new 3-week lows in the 1.0980/75 band.

EUR/USD stays offered on USD-strength

EUR/USD continues to fade Monday’s advance on the back of the strong pick-up in the demand for the greenback, in turn sustained by the ongoing funding squeeze around the buck.

The buying interest in the dollar is also showing rising scepticism and cautiousness among investors despite the recent Fed’s move on rates and after the central bank pumped trillions of dollars into the system.

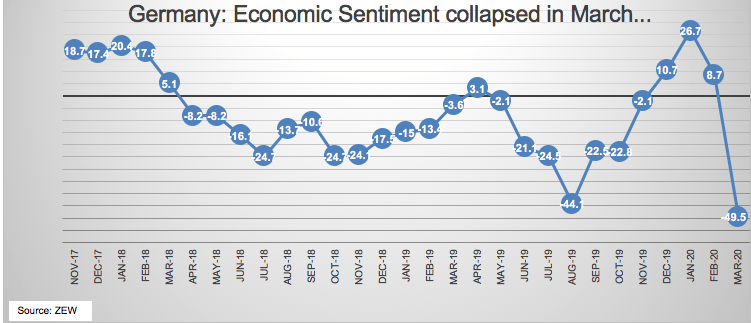

Additionally, the euro has debilitated further in response to poor prints from the German/EMU ZEW survey for the current month. In the US calendar, advanced Retail Sales contracted at a monthly 0.5% during February, while core sales fell 0.4% MoM. In addition, Industrial Production expanded 0.6% inter-month and Capacity Utilization eased to 77.0% during the last month.

What to look for around EUR

EUR/USD remains under heavy downside pressure so far this week on the back of the strong comeback of the greenback, unabated COVID-19 concerns and fresh wave of easing monetary policy conditions by major central banks. On the macro view, recent horrible prints in both Germany and the broader Euroland gave investors a “slap of reality” and hinted at the idea that a serious recovery in the region is still far away. This view is reinforced by the (un)expected impact of the coronavirus on the economy of the region.

EUR/USD levels to watch

At the moment, the pair is losing 1.79% at 1.0980 and faces the next support at 1.0879 (monthly low Oct.1 2019) seconded by 1.0814 (78.6% Fibo of the 2017-2018 rally) and finally 1.0777 (2020 low Feb.20). On the flip side, a breakout of 1.1236 (weekly high Mar.16) would target 1.1495 (2020 high Mar.9) en route to 1.1514 (high Jan.31 2019).