- EUR/USD comes under extra downside pressure near 1.1130.

- German IFO came in on the soft side in May.

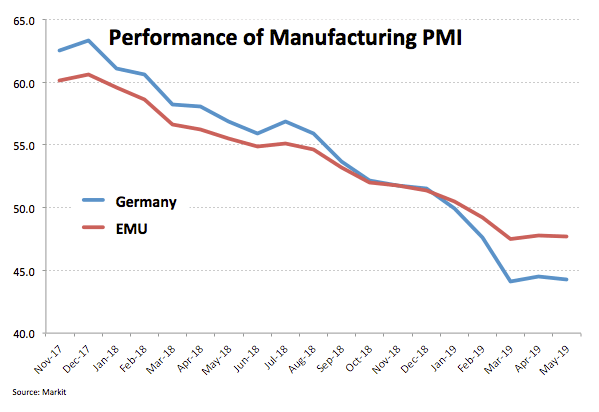

- German/EMU flash PMIs surprised to the downside.

Another bout of selling pressure around the shared currency forced EUR/USD to test new multi-week lows at 1.1130 on Thursday.

EUR/USD offered post-poor data releases

Spot came under further selling pressure on Thursday following disappointing results from the euro docket earlier in the day.

In fact, spot clinched fresh 4-week lows in the 1.1130 region after the German IFO survey came in on the soft tone for the month of May, showing Business Climate declining to 97.9, Current Assessment dropping to 100.6 and Business Expectations ticking a (very) bit higher to 95.3.

Adding to the sour sentiment in EUR, advanced manufacturing PMIs in Core Euroland for the current month noted the downtrend below the 50 threshold stays unabated so far.

Moving forward, the critical European parliamentary elections kick in today, whereas speeches by ECB’s De Guindos and Nowotny are also due ahead of the publication of the ECB minutes.

Across the ocean, Initial Claims, New Home Sales and speeches by FOMC’s Daly, Bostic, Kaplan and Barkin should keep traders entertained later in the NA session.

What to look for around EUR

Recent data releases in Euroland and Germany have poured cold water over the idea that some healing process could be under way in the region, re-shifting the focus to the ongoing slowdown and its probable duration and extension. In the meantime, the current ‘neutral/dovish’ stance from the ECB is expected to persist for the remainder of the year and probable through H1 2020. The broad-based risk-appetite trends and USD-dynamics should dictate the sentiment surrounding the European currency for the time being, all in combination with the now stalled US-China negotiations and potential US tariffs on EU products. On the political front, Italy has re-emerged as a source of uncertainty and volatility, while investors’ focus has now shifted to the EU parliamentary elections due later this week.

EUR/USD levels to watch

At the moment, the pair is losing 0.08% at 1.1141 and faces the next support at 1.1130 (low May 23) seconded by 1.1109 (2019 low Apr.26) and finally 1.0839 (monthly low May 2017). On the flip side, a break above 1.1183 (21-day SMA) would target 1.1217 (23.6% Fibo of the 2019 drop) en route to 1.1236 (55-day SMA).