- EUR/USD retreats from two-week tops, as USD bulls regain control.

- The spot recaptures the 200-DMA but upside capped by a pullback in US rates.

- Bullish RSI still keeps the buyers hopeful, with eyes on 50-DMA.

EUR/USD is retreating further from two-week highs of 1.1927, as the bears test the 1.1900 support area amid resurgent haven demand for the US dollar whilst the Treasury yields recover.

The relentless rise in coronavirus cases across Asia, concerns over the side-effects of the AstraZeneca vaccine and mixed Chinese inflation data spook investors, as they run for safety in the US dollar. The Treasury yields also attempt a bounce after Fed Chair Jerome Powell’s dovish comments-induced slide.

The EUR traders now look forward to a slew of second-tier macro news from the Eurozone, including the Industrial Production data. Meanwhile, the US dollar price action may continue to influence the pair ahead of the US Producers Price Index (PPI) release later on Friday.

EUR/USD: Technical outlook

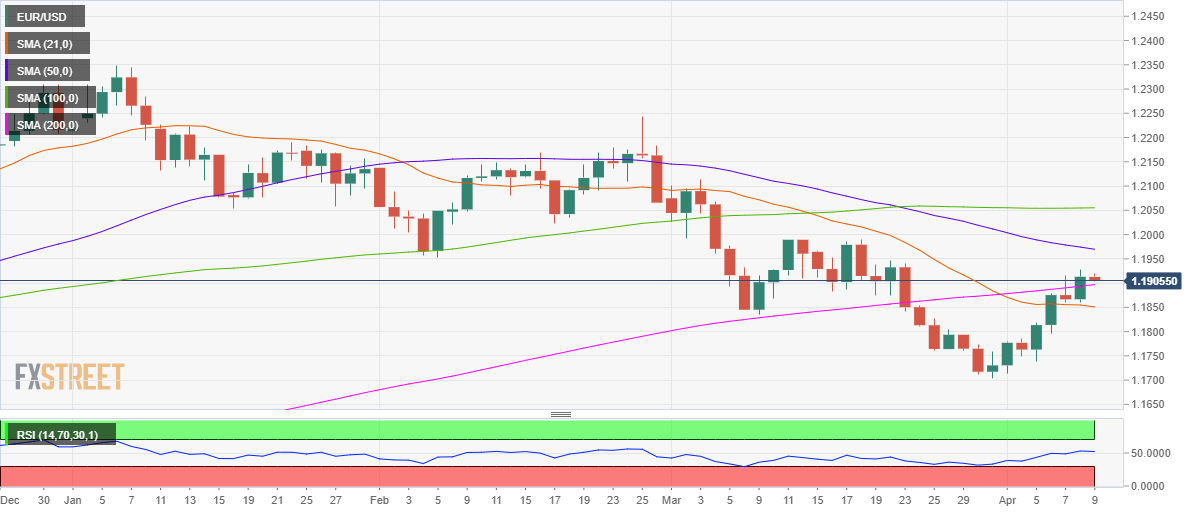

EUR/USD: Daily chart

The near-tern technical perspective appears constructive, as observed on the daily chart. EUR/USD recaptured the 200-daily moving average (DMA) at 1.1894 on Thursday, as the 14-day Relative Strength Index (RSI) pierced through the midline from below.

The technical setup remains in favor of the bulls, at the moment, despite the pullback in the spot from higher levels.

Therefore, the EUR buyers continue to aim for the 50-DMA resistance at 1.1969 so long as the 200-DMA support holds.

A sustained break below the latter could expose the horizontal 21-DMA at 1.1850.

To conclude, the upside appears more compelling for the main currency pair, with investors likely to resort to bargain buying at lower levels.

EUR/USD: Additional levels