- EUR/USD loses momentum and recedes to sub-1.10 area.

- May’s German preliminary inflation figures due later.

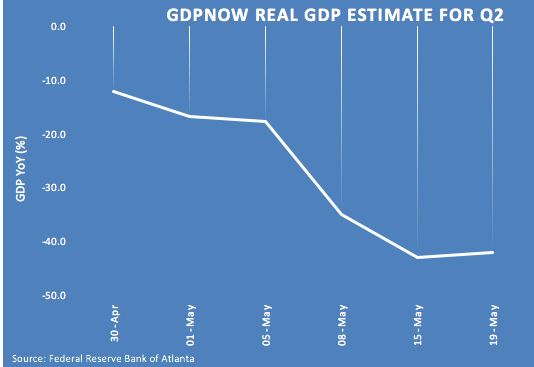

- US advanced Q2 GDP will be the salient event in the NA session.

After a test of new multi-week highs in the 1.1030/35 band, EUR/USD seems to have lost some momentum and is now returning to the sub-1.10 zone.

EUR/USD focused on data, risk trends

EUR/USD has managed to finally surpass the 1.10 barrier on Wednesday following the better mood in the risk-associated complex, particularly after the European Commission (EC) unveiled a €750 billion aid package to help with the economic recovery.

In addition, the progress on the gradual re-opening of the economy both in the euro area and the US continues to lend support to the pair as well as headlines highlighting potential COVID-19 vaccines.

Data wise in Euroland, flash CPI in Spain noted consumer prices are seen flat on a monthly basis in May and contracting 1.0% from a year earlier. In addition, Italian Consumer Confidence came in at 94.3 for the month of April. Surpassing estimates. Still in the region, EMU’s Consumer Confidence is due later along with advanced German inflation figures for the current month.

Across the pond, all the attention will be on the flash Q2 GDP figures, Initial Claims and Durable Goods Orders seconded by Pending Home Sales and the weekly report by the EIA.

What to look for around EUR

EUR/USD has finally managed to reclaim the 1.1000 barrier although it still struggles to keep consolidate business above it. In the meantime, USD-dynamics keep driving the sentiment around the pair, always looking to the US-China trade jitters and the coronavirus economic aftermath. The recent better-than-expected results in Germany and the broader euro area along with positive prospects regarding the re-opening of some economies in the bloc appear to keep occasional bearish attempts contained, all helped by the solid position of the euro area’s current account. In the political scenario, the recent German court ruling against purchases of sovereign debt under the ECB’s QE programme threatens to widen the existing cracks within the euro area and could limit any serious recovery in the currency. This view has been also exacerbated after the French-German proposed fund to help economies to recover from the coronavirus fallout met resistance among some Northern-European members.

EUR/USD levels to watch

At the moment, the pair is losing 0.04% at 1.0998 and faces immediate contention at 1.0870 (weekly low May 26) seconded by 1.0774 (weekly low May 14) and finally 1.0727 (monthly low Apr.24). On the upside, a break above 1.1035 (monthly high May 28) would target 1.1147 (weekly high Mar.27) en route to 1.1186 (61.8% Fibo of the 2017-2018 rally).