- EUR/USD has surged amid vaccine optimism, QE reaction divergence, and other factors.

- Biden’s China comments and Trump’s stimulus skepticism may trigger a downtrend correction.

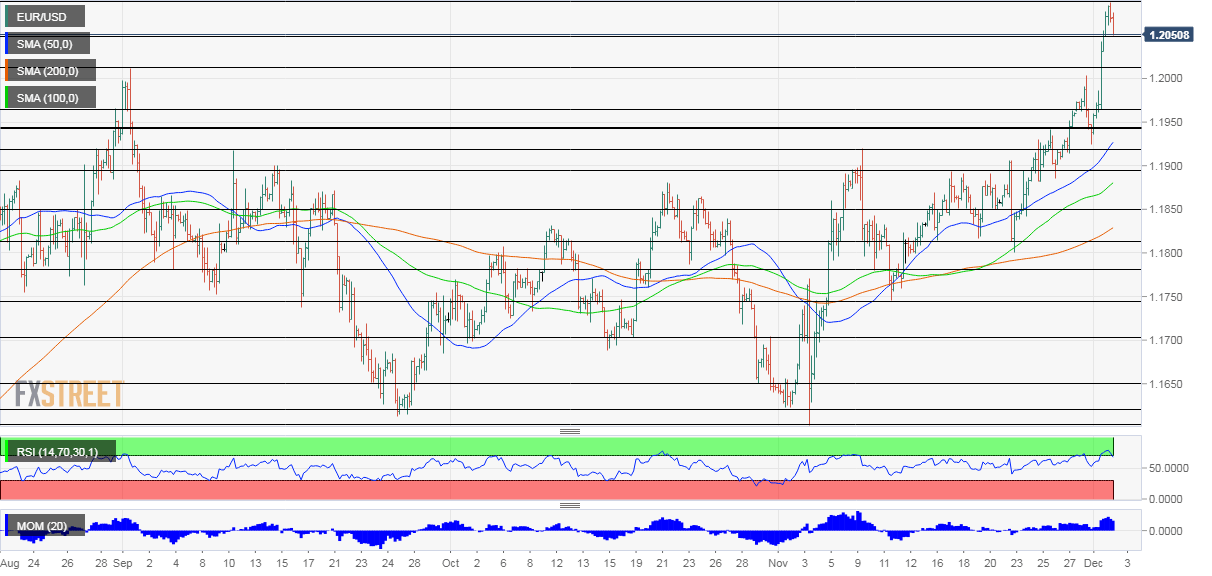

- Wednesday’s four-hour chart is showing stretched overbought conditions.

A big breakout in EUR/USD – something that traders have been longing for – has finally happened. Has it gone too far? Here are the reasons for the rise and why it could suffer a setback, at least a temporary one.

EUR/USD upside drivers

Vaccine: The UK approved the Pfizer/BioNTech coronavirus vaccine for use and the first shots may be given next week. Britain is the first country in the West to approve immunization and other authorities will follow. The development is not a shocker, but cheers investors and pushes the safe-haven dollar down.

US fiscal stimulus? A bipartisan group of Senators unveiled a $908 billion relief package. Markets had already dismissed the chances of any accord during the lame-duck period, and the effort also improves the mood.

These are the latest upside triggers, yet the breakout is also the fruit of higher political certainty and also the divergence in how markets react to the monetary stimulus. Additional Quantitative Easing is euro-positive in the covid era while dollar-printing remains weigh on the dollar.

See EUR/USD Forecast: Three reasons for the massive breakout and big levels to watch

Reasons for a correction

Sino-American relations: President-elect Joe Biden told the New York Times that he will first conduct a review of relations with China before removing any tariffs. He would also consult allies. While a hawkish approach against Beijing is not surprising, the prospects of an ongoing clash between the world’s largest economies is weighing on sentiment.

US relief package may have to wait: Outgoing President Donald Trump is reportedly conditioning his approval of a stimulus package on curbing the abilities of tech companies and may also want to stick other things to a deal. Trump has yet to concede his loss despite an admission by his Attorney General William Barr that there had been no widespread fraud. The president is not going out quietly.

US data remains of high interest. ADP’s private-sector jobs report is set to show an increase of 420,000 jobs in November, more than 365,000 in October. The release serves as a hint toward Friday’s Nonfarm Payrolls.

See ADP Jobs Preview: Even a minimal beat could trigger a greenback comeback

Concerns about weaker labor figures came from the ISM Manufacturing Purchasing Managers’ Index released on Tuesday. While the headline figure pointed to robust growth, the employment component contracted.

Overall, the trend remains to the upside but a considerable correction cannot be ruled out after the rally.

EUR/USD Technical Analysis

The Relative Strength Index on the four-hour chart is significantly above the 70 level – indicating overbought conditions and an upcoming correction. Momentum remains to the upside and the currency pair trades above the 50, 100, and 200 Simple Moving Averages, allowing for the uptrend to resume after a move to the downside.

Euro/dollar has hit a high of 1.2087, which is around a critical level recorded back in the spring of 2018. The next level to watch is 1.2150.

Some support awaits at the daily low of 1.2050. IT is followed by the previous yearly high of 1.2010 and then by 1.1960.